The key to blockchain security lies in the 'slash' and 'incentive' mechanisms, as everyone knows...

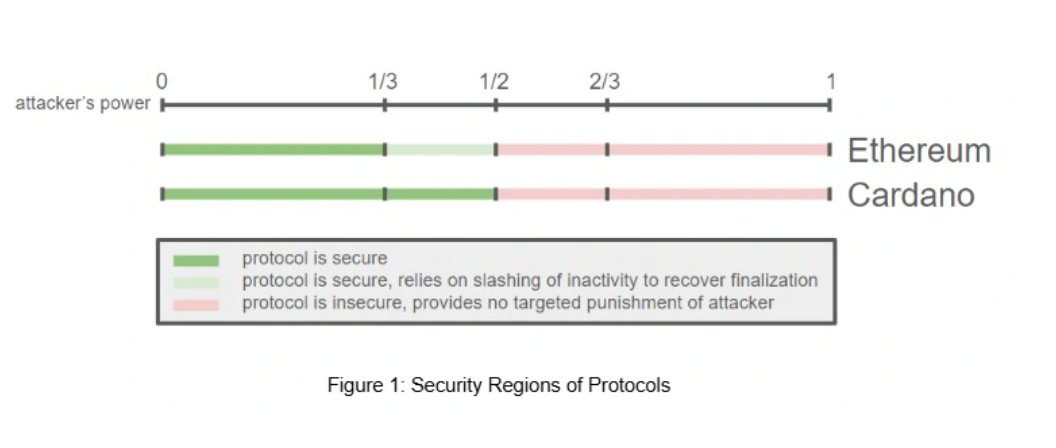

Interestingly, Ethereum utilizes both slashing and incentives, while Cardano only employs the incentive mechanism.

In this article 'To slash or not to slash', the mechanisms of the two are compared in an interesting way, so I summarized it.

First, Ethereum is a slashing-based model that 'punishes' validators when they make mistakes. If the rules are broken, the staked shares are reduced. The consensus method used is Iterated BFT.

Ethereum's basic consensus model can be vulnerable to attackers holding more than one-third of the stake. Therefore, slashing exponentially increases the cost of such attacks, making it a key mechanism to enhance security to about 50%.

If mistakes like double-signing occur, the stake is sharply reduced. However, there are also drawbacks to slashing.

- Loss of control over funds: When staking, money is locked up and cannot be used freely.

- Centralization: Staking tends to concentrate in large specialized firms that can manage risks.

- Decreased participation rate: Due to these risks, regular users tend to shy away from staking. In fact, the staking rate for Ethereum is about 28%, which is relatively low.

On the contrary, what's interesting is that Cardano has no 'punishments' and instead uses a model that encourages honest behavior solely through 'rewards'.

In other words, there is no slashing at all. It uses the 'Ouroboros protocol', which is based on Nakamoto consensus.

The reason there is no slashing is that the consensus model itself is fundamentally safe as long as the attacking stake is below 50%.

If higher security is needed, users can simply wait until more blocks are accumulated (user-defined finality). It allows for flexible delegation without the need to lock up staking, making participation easier.

What if malicious actions are taken? Instead of slashing, punishment occurs through market principles.

If the operation fails, delegators will move their stakes to other pools, and that pool will naturally see a decrease in rewards and influence, leading to its decline. Thanks to this feature, the staking ratio is about 58%, which is said to be favorable for decentralization.

Ultimately, the difference in the security mechanisms of the two networks fundamentally stems from the difference in their consensus algorithms.

Since IOHK is the developer of Cardano, it is naturally an article that is favorably organized towards Cardano.

However, I believe that the two protocols differ not because one is superior to the other, but because they pursue different goals...

Personally, I think there is no stronger deterrent against attacks than slashing... Moreover, slashing not only prevents 'malicious attacks' but can also ensure 'stable operation'.

There are also assets staked in poorly managed staking pools in Cardano...

In conclusion, it is a difference in design philosophy...

However, I believe we need to pay attention to Cardano, which is trying to solve problems in a new way that is different from Ethereum, the standard of this market...

10.32K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.