Made Two Adjustments to My DeFi Strategies

👉 1. Bought FragSOL PT on RATEX

After playing in crypto for a while, I’ve realized the highest returns often come from liquidity premiums. There's a reason why people say “where attention goes, money follows.”

That’s because even in a so-called "fast runner" game with strong consensus, there’s always an element of timing, luck, and human nature. People are inherently drawn to participate in what feels like a fair gamble.

For project teams, the TGE (Token Generation Event) phase is usually when liquidity premiums are at their peak. During this period, those premiums often flow through the DeFi pipeline onto the chain.

On the other hand, FragSOL’s PT has a 71-day duration, 18% APY + 4X RATE X points. From the perspective of duration, yield, and potential airdrops, it’s pretty solid—a little six-dimensional warrior, if you will.

A rough estimate puts the SOL-denominated yield at around 20% APY. However, my SOL was borrowed in USD terms.

After crunching the numbers, the overall APY based on my entire USD portfolio fluctuates between 10% and 20%. Not bad—though it doesn’t beat @OpenEden_X’s CUSDO PT. But honestly, that stablecoin’s KYC is just anti-human.

If you weren’t born to be a Westerner, maybe don’t chase Western money. Just saying—if it weren’t for that KYC wall, PT yields wouldn’t be so high in the first place.

👉 2. Preparing to Exit the USDS LP Position on PENDLE

Honestly, I should’ve exited a while ago. Once the USDS pool on Pendle surpassed $200 million, the risk-reward ratio began dropping sharply. Now it’s approaching $400 million, with nearly 20 billion new points being added daily.

To make matters worse, the project hasn’t launched a token yet, and SPK staking points are also counted—so the real APY on USDS-PT 4.5 is much lower, maybe even below that.

My only remaining hope is farming points on @sparkdotfi via @cookiedotfun. A few days left—will they give me a last-minute point boost? SNAPSNAPSNAP~ 😛

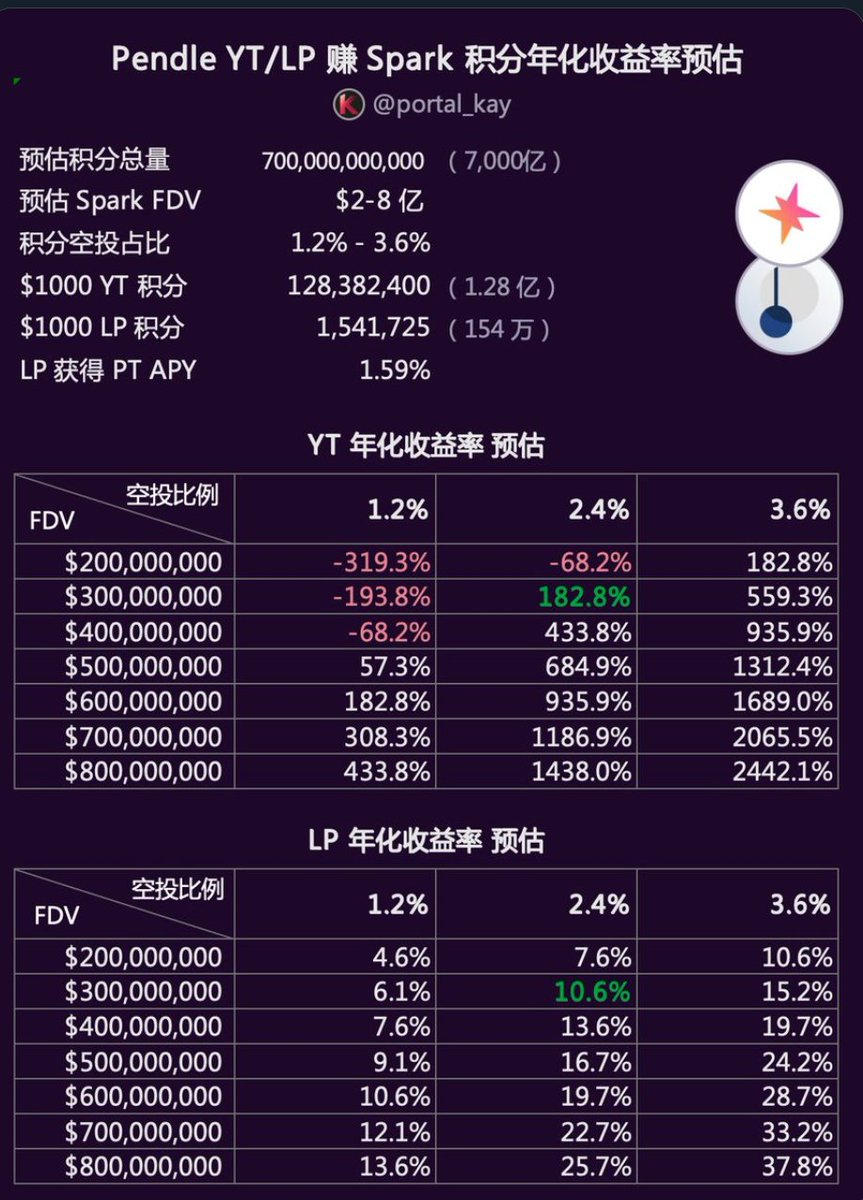

Many people have already calculated the USDS airdrop potential on PENDLE.

Here, I’ll borrow a chart from @portal_kay. The projected total points were 700 billion, but now estimates are going as high as 1.4 trillion.

At that point scale, even in the most optimistic scenario of a 2.4% airdrop with a $500 million FDV, the real APY would only be around 8%. Pretty underwhelming. I’m moving on to better opportunities.

On that note, here’s another thought:

We might not only miss out on the altcoin season—we might never even get tokenized US stocks on-chain.

Ironically, the biggest undercurrents right now are in the direction of US stocks on-chain.

MicroStrategy’s BTC treasury model is being mimicked by tokens on other chains.

And it’s surprisingly easy to create an SPV (Special Purpose Vehicle) to hold U.S. stocks.

Maybe the idea of an altcoin season... happening in the U.S. stock market instead of crypto isn’t a joke.

Am I really about to pick up my old profession again and start analyzing U.S. stock earnings reports for everyone? 😂

Time’s tight—more on this “on-chain U.S. stocks” thesis later, including the logic behind it.

Show original

19

15.34K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.