I've held my BTC for a long time without selling, actively participating in BTCFi within the ecosystem to earn some interest. After Babylon's airdrop, I gradually started unstaking SolvBTCBBN and began looking for new projects to join. Recently, considering the altcoin market might have potential in the second half of the year, I'm exploring whether I can mint corresponding stablecoins on-chain first, then put them into a quantitative fund for financial management. After some research, Mezo seems pretty good, so I'll share Mezo's business.

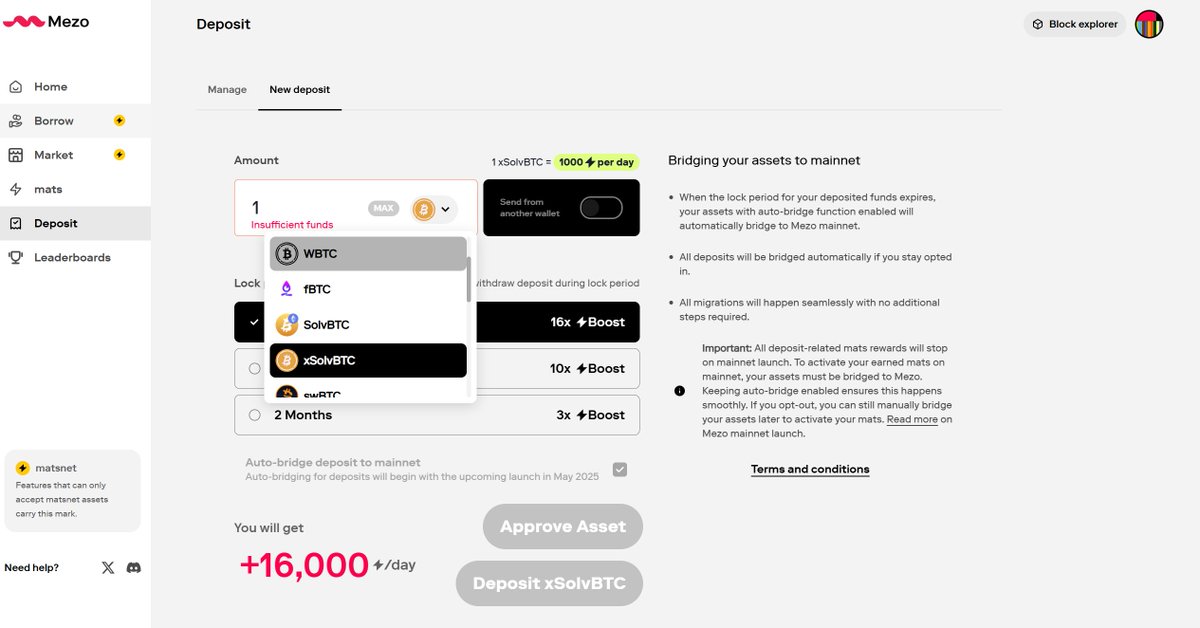

Mezo is a company that offers stablecoins collateralized by Bitcoin. Users can pledge various types of BTC (like my SolvBTCBBN) and mint MUSD on-chain through 110% over-collateralization, allowing them to engage in DeFi on-chain. My approach is to exchange MUSD for USDT and then use it for quantitative trading to earn interest spreads. Mezo's collateralized lending annual interest rate is between 1%-5% (centralized Antalpha's BTC lending rate is 8%+), and the quantitative benchmark is over 8% annualized (referencing Ethena), which can actually yield several percentage points, not even counting the airdrop benefits. The company has already reached a TVL of $200 million, with data growing rapidly. On the 7th of this month, Mezo's Ethereum vaults officially opened, allowing users to deposit various types of BTC into vaults and start farming. After the mainnet launch in late May, users can mint MUSD stablecoins/inject into pools, and also collaborate with company partners like Velar, Threshold, Zerolend, etc., to earn more points. For more details, see

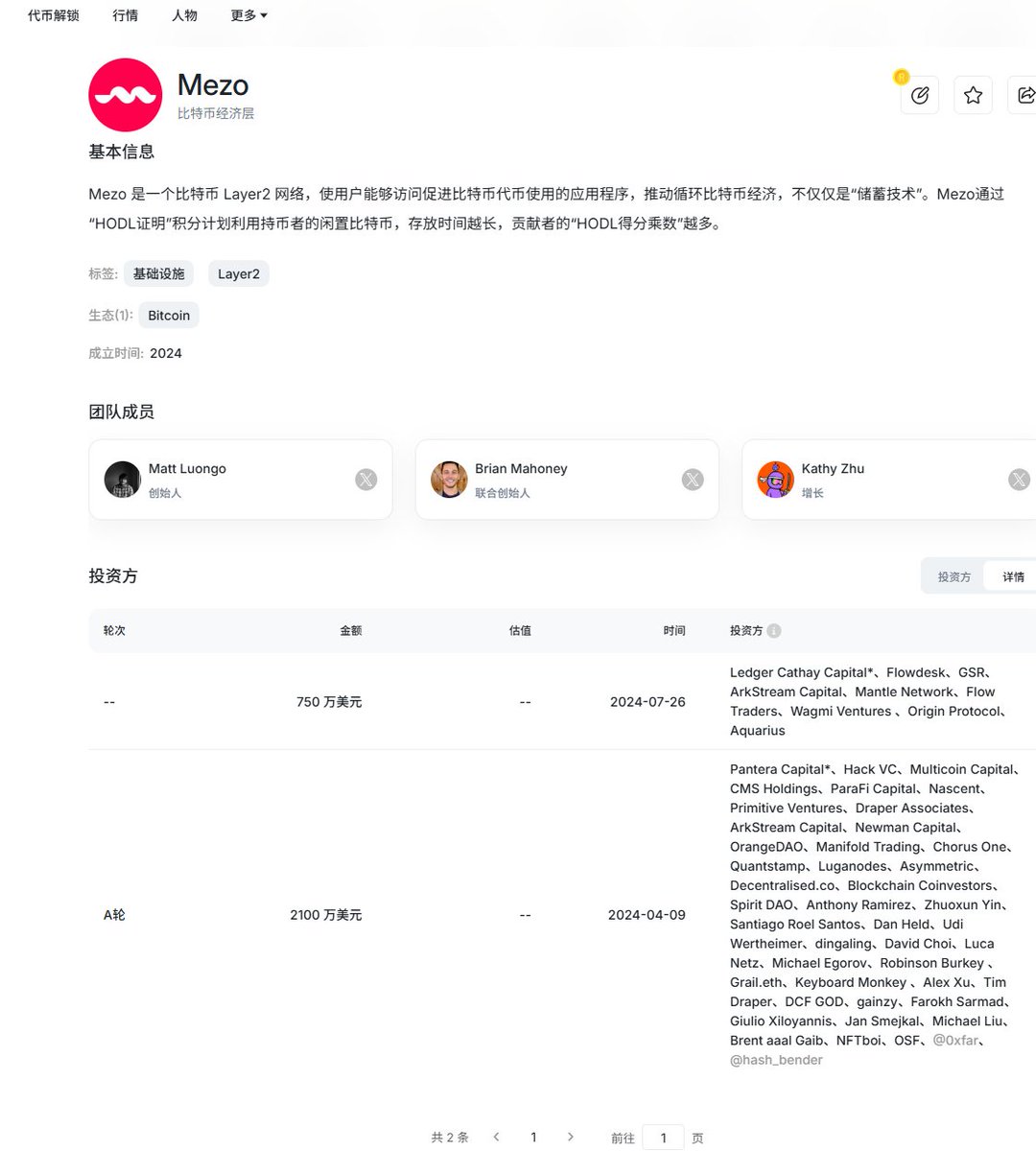

Let's take a look at Mezo's financing situation. The company raised $28.5 million in 2024, with $21 million in Series A led by Pantera, with participation from Hackvc, Multicoin, etc.; in July, there was another round of financing with participation from Ledger Cathay Capital, Flowdesk, GSR, and other market makers. The company's valuation in the last round was at least over $200 million. Now that the leading projects have completed asset management and staking, the next big direction is lending and stablecoins. As a leading project in BTC stablecoins, Mezo is very suitable for BTC OGs to continue unlocking BTC liquidity to leverage themselves.

Show original

24.99K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.