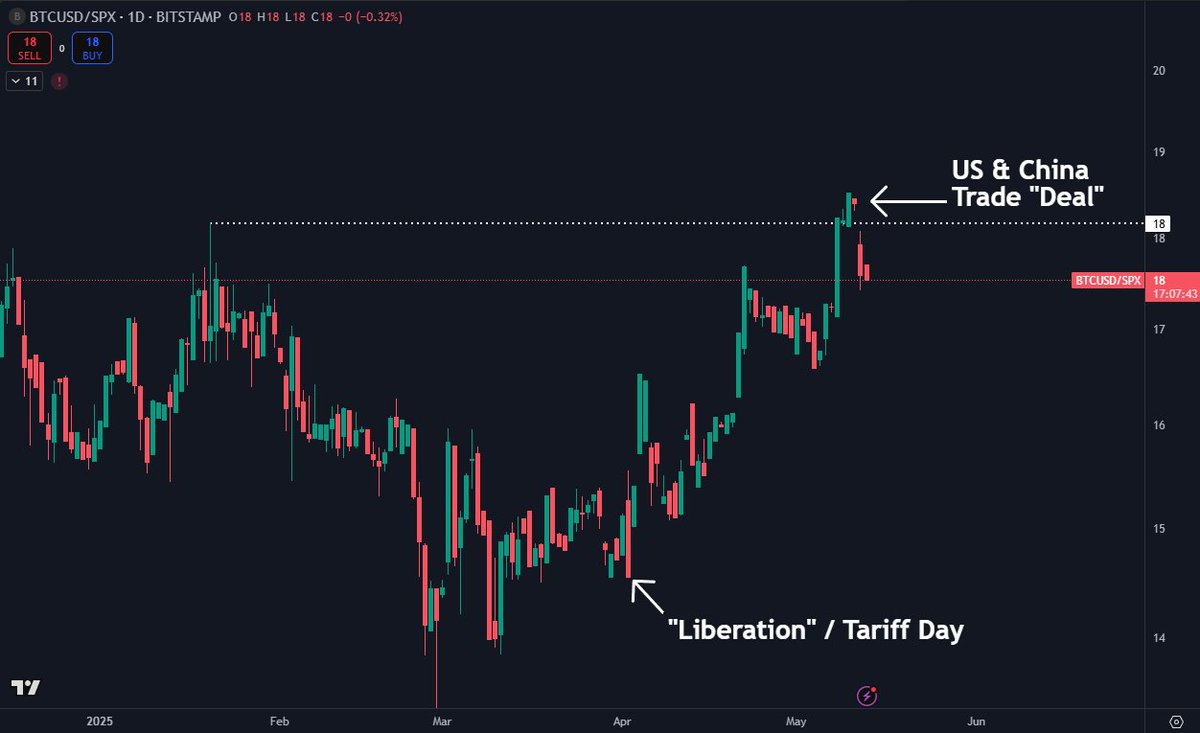

$BTC So far with a sharp rejection from the all time high BTC/SPX ratio. Not entire surprising hence me highlighting this chart this weekend.

It seems that the trade uncertainty was one of the driving factors at least in the eyes of investors.

With the US - China "Deal" made and Tariff uncertainty fading, stocks were the ones that benefitted most. This caused some selling on $BTC and for the BTC/SPX ratio to come down by about 5% so far.

At this point it's safe to assume BTC does act as a risk asset but does also tend to be an asset where money allocates into during these uncertain situations surrounding trade and issues with things like banks (March 2023).

As BTC is maturing and the market gets bigger, it will eventually work more and more like what it was designed for I think.

$BTC Has outperformed stocks since "Liberation" / Tariff Day on the 2nd of April.

It held up incredibly strong during a sharp sell off on stocks in April.

It then also proceeded to outperform as the markets bounced and tariffs were implemented.

Back then people were wondering if a reason for the relative strength could have been the narrative that countries could potentially be using $BTC to bypass tariffs.

With a potential US & China Trade "Deal" teased/announced today we could be seeing the answer to this question.

Theoretically speaking, if the trade uncertainty was what was making BTC outperform, it should stop outperforming after we hit the most important deal which includes China.

If BTC keeps doing its thing and just keeps outperforming it's safe to assume that tariffs likely have little direct impact on how BTC is treated/used.

22.92K

138

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.