I have not sold my BTC for a long time, and I have been actively participating in BTCFi in the ecosystem to earn some interest. After Babylon released the airdrop, I gradually de-staked SolvBTCBBN and started looking for new projects to participate. Recently, considering that the copycat market may be promising in the second half of the year, let's see if we can mint the corresponding stablecoin on the chain first, and then put it into the quantitative fund for financial management.

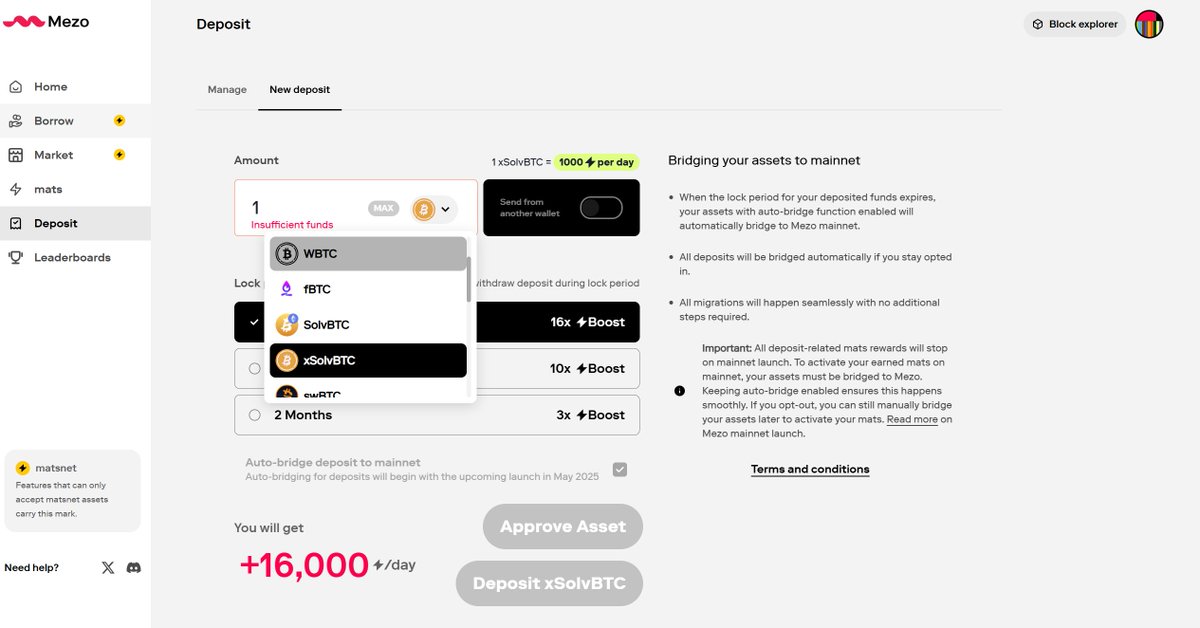

Mezo is a Bitcoin-backed stablecoin company. Users mint MUSD on-chain by staking various types of BTC (such as my solvbtcbbn) through 110% over-collateralization, and then they can do defi on-chain. My own operation is to convert MUSD to USDT, and then do quantitative to the quantitative company to earn interest margins. The annualized interest rate of Mezo mortgage lending is 1%-5% (the BTC lending rate of centralized antalpha is 8%+), and the quantitative benchmark is more than 8% annualized (refer to ethena), which can actually make a few points larger, and it has not yet counted the income of the airdrop. Now the company has achieved $200 million in TVL, and the data is growing rapidly. On the 7th of this month, Mezo's Ethereum vaults began to be officially opened, and users can deposit various types of BTC into the vaults and start farming. After the mainnet is launched in late May, users can mint MUSD stablecoins/inject pools, etc., in addition, they can also cooperate with the company's partners Velar, Threshold, Zerolend, etc., to earn more points, see details for details

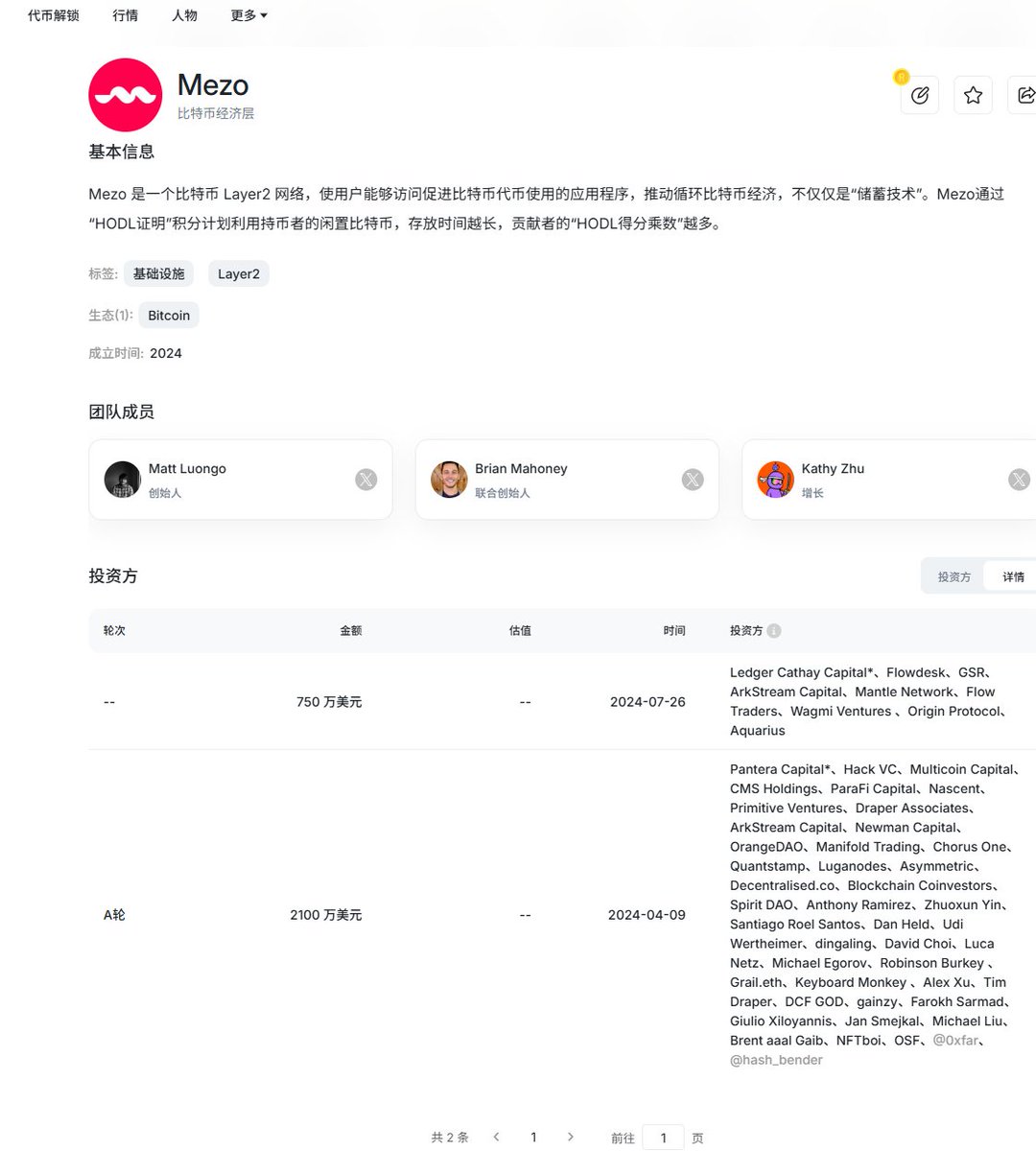

Let's take a look at Mezo's financing, the company raised $28.5 million in 24 years, $21 million in Series A, led by Pantera, with Hackvc, multicoin and other participation; In July, there was another round of new funding, with the participation of Ledger Cathay Capital, as well as market makers such as Flowdesk and GSR. In the final round, the company was valued at least $200 million or more. Now that the head project has completed asset management and staking, the next major direction is lending and stablecoins. As the current head project of BTC stablecoin, Mezo is very suitable for BTC OGs to continue to liberate BTC liquidity to increase their leverage.

Show original

25.07K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.