Demystifying the VC Bets - WTF is Initia? 🪢

Yesterday, @InitiaFDN announced a $14M Series A, bringing total funds raised to $22M. Another major step towards making the vision of "Interwoven Rollups" a reality.

What does that mean and why are VCs throwing millions of $$$ at this emerging team?

We did the research so you don't have to. ⤵️

✪ TL;DR

@InitiaFND is a cohesive ecosystem of interoperable, optimistic rollups built on the Initia L1, a MoveVM-based Cosmos chain running a CometBFT consensus mechanism.

The L1 serves as a unification layer for liquidity, enables interoperability across rollups and serves as a shared security layer with enshrined liquidity.

Initia rollups, a.k.a. Minitias, are IBC-enabled and built on the OPinit stack, a VM-agnostic optimistic rollup framework developed by the Initia team. They support sub-second blocktimes and can process thousands of TPS at consistently low cost with @CelestiaOrg underneath.

The end goal of the Initia product stack is to offer users a unified UX across 1000s of interwoven, app-specific rollups (Omnitia ecosystem) that do not suffer the limitations of monolithic blockchains and contemporary, single VMs.

➊ The Initia Technology Stack

The Initia L1 serves as an orchestration layer in the Omnitia ecosystem, facilitating coordination, providing shared security, enabling cross-rollup interoperability and routing liquidity across apps.

The chain is based on the Cosmos SDK, utilizing the highly performant CometBFT (formerly Tendermint) consensus mechanism, and incorporating MoveVM for smart contract execution.

It is also the basis of "Omnitia Shared Security", the security framework that underlies all Initia rollups.

For fraud proof challenges on an Initia L2, the L1's validator set adjudicates the dispute.

A process that is streamlined through the integration of @CelestiaOrg light clients within the validator nodes.

These light clients allow for the verification of data across Minitias without the need to download full blocks.

This works because Minitias post transaction data directly to Celestia, facilitating deterministic verification of the rollup chain's state transitions.

By using Celestia’s Namespaced Merkle Trees to post their data to Celestia, Minitias also ensure that relevant stakeholders can download and verify only the data they care about, optimizing resource usage.

➋ The Omnitia Ecosystem

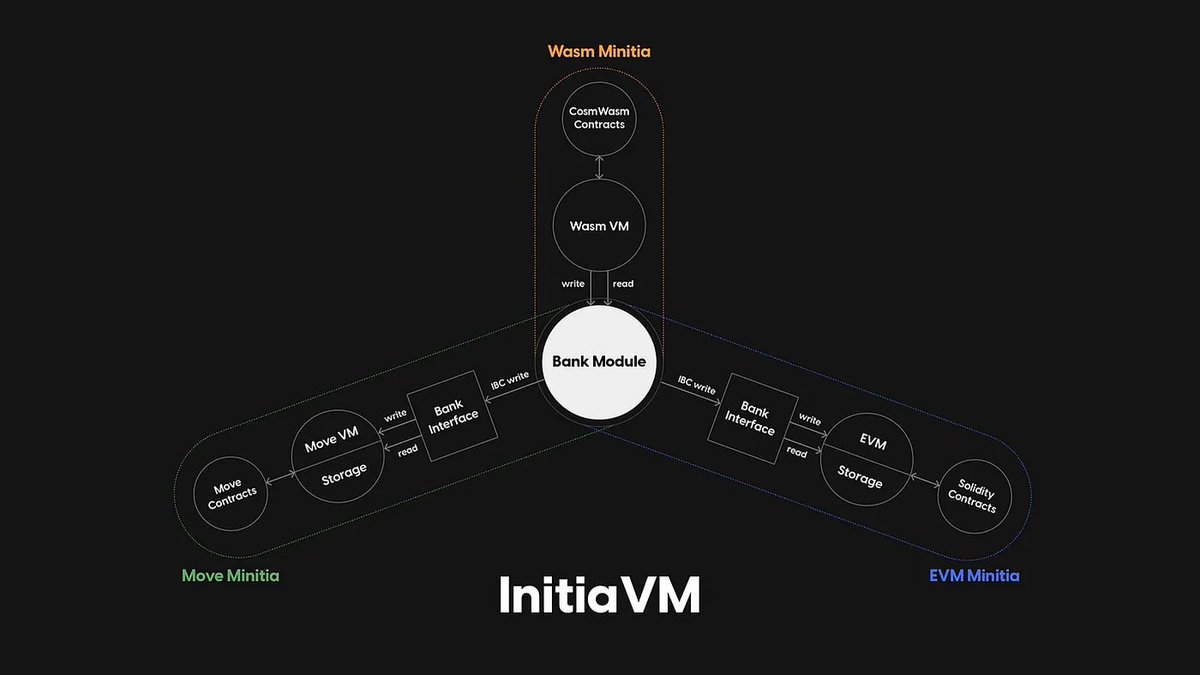

As mentioned before, the OPinit stack supports rollups on the Initia L1 that run EVM, MoveVM, or WasmVM, while leveraging Celestia for DA.

Minitias function as fully operational Cosmos SDK blockchains that use optimistic rollup technology for settlement (ultimately relying on Initia validators for finality) and are seamlessly interoperable among each other.

They feature rapid block times of 500ms and are capable of handling over 10,000 transactions per second.

Collectively, all Minitias form the Omnitia ecosystem.

What's definitely notable, is that Init successfully managed to bootstrap an entire ecosystem of Minitias already before mainnet.

This includes:

➤ @blackwing_fi (Liquidation-free margin trading)

➤ @TucanaNetwork (Omnichain liquidity hub)

➤ @milky_way_zone (Modular (re)staking platform)

➤ @lunch_xyz (All-in-one Web3 consumer app on Noon Minitia)

➤ @civitiaorg (Mint cities, collect yield & collaborate in a social game)

➤ @Inertia_fi (Interwoven liquid staking and lending protocol)

➤ @Chai_ (The yield terminal and alpha engine)

➤ @controrg (Chain for ultra-fair DEXes and p2p markets)

➤ @zaar_gg (NFTs and degeneracy on Fun Network)

➤ @Minity_xyz (Track your assets, DeFi positions and NFTs)

➤ Init AI (Generative, AI-powered platform to turn prompts into NFTs)

➤ Many more to come

To achieve its vision of a multichain UX that is akin to a singular, monolithic chain, the Initia ecosystem also features:

➤ InitiaScan: Multi-chain explorer with VM-specific tools & information

➤ Initia Wallet: Dedicated wallet for navigating the ecosystem

➤ Wallet Widget: Supports EVM/Cosmos wallet signing & social login

➤ Bridget: Frontend bridge/on-ramp aggregator integrated on rollups

➤ Initia App: Centralized platform for anything related to Initia

➤ Initia Usernames: Ecosystem-wide, on-chain identity system

A likely powerful set of tooling and infra components, both for builders and users within the ecosystem.

➌ Enshrined DEX & Liquidity

@InitiaFND also enshrines liquidity.

What does that mean?

Initia's L1 incorporates a native multichain DEX that functions similarly to @Balancer, enabling both weighted and stableswap pools.

This DEX module enables the L1 to support not only the native $INIT token but also pairs of $INIT with other tokens that have been whitelisted through governance processes (e.g., $INIT <> $USDC, $INIT <> $stATOM) for staking purposes (= leveraging liquidity for security).

This introduces significant benefits to the ecosystem:

➤ Mobilizes productive assets

➤ Diversifies security by reducing reliance on $INIT volatility

➤ Enhances staking rewards through swap fees & token yields

➤ Significantly boosts L1 liquidity for both L1 apps & L2 chains

➤ Whitelisted LP tokens can be used for gas payments

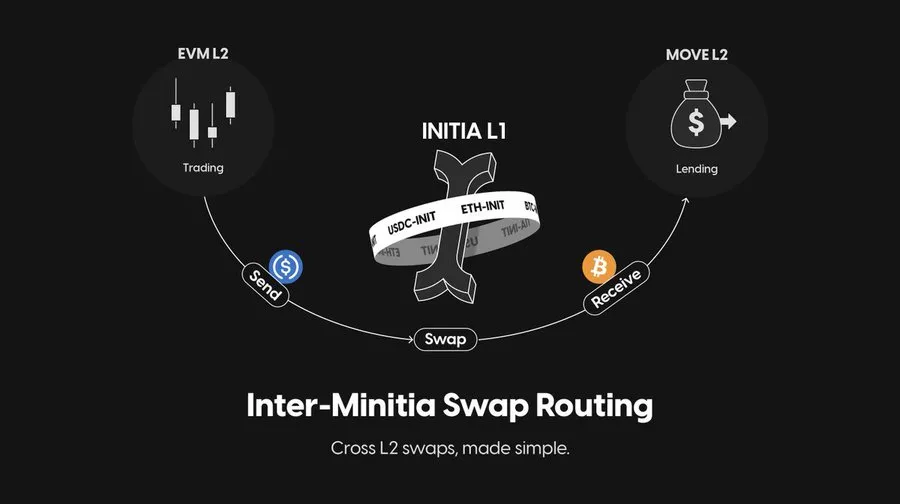

Moreover, the DEX is crucial for inter-Minitia liquidity routing and facilitates L2 chain transfers via the L1, with potential for token swaps during the transfer (=integrated cross-chain swaps).

Thereby, the DEX also addresses the traditionally lengthy withdrawal times of optimistic bridges. It enables fast token bridging between Initia L1 and Minitias, allowing users to bypass the challenge period for quicker withdrawals.

➍ Team & Backers

Founded by @sinitias and @ItsAlwaysZonny, Initia has been quick to garner mindshare in the modular space.

Other notable Initia team members include:

➤ @0xJESSIE_ (DevRel)

➤ @OmniscientAsian (Ecosystem)

➤ @0xMista (Bruv)

➤ @tittyrespecter (Dog)

➤ @jennitiaj (Real Dog)

➤ +++

The team successfully raised $22.5M in total funding with a Series A led by @ttunguz and @SpencerFarrar at @theoryvc, and with participation from @Delphi_Ventures and @hack_vc accounting for $14M.

More early supporters also include @BinanceLabs, @nascentxyz, @FigmentCapital, @BigBrainVC among others.

Aside the VCs, Initia also has an impressive angel line-up, which includes:

➤ @PrimordialAA

➤ @gametheorizimg

➤ @nosleepjon

➤ @0xCygaar

➤ @keoneHD

➤ @leptokurtic_

➤ @icebergy_

➤ @newmichwill

➤ @zmanian

➤ @chainyoda

➤ @n2ckchong

➤ @0xNairolf

➤ Many more

➎ ████████ Conclusion

Initia is definitely bringing some interesting, unique innovations to market, and the team has absolutely excelled at building a strong brand and a vibrant ecosystem, even before mainnet is live.

However, competition, especially in the rollup game is fierce.

In the past, similar Cosmos-based rollup ecosystems such as @dymension or @Sagaxyz__ have hence struggled to find wider adoption.

While in the case of Initia the ecosystem and community seem much more mature, it will still be a tough battle to compete with Ethereum or Solana as the primary base / settlement layers for rollup networks.

Especially in the Ethereum ecosystem, there are already many rollup stacks to build with, which include Polygon's CDK, Optimism's OP stack, the @arbitrum Orbit stack or the soon to be launched rollup OS by @fuel_network, among others.

All of these rollup ecosystems are working towards enabling different architectures or VMs, are building proprietary interop / liquidity unification solutions and integrate all sorts of modular infra (incl. DA layers like Celestia but also Avail).

While technologically still interesting as a stack (OPinit), the Initia ecosystem hence definitely also needs liquidity & users to generate network effects to remain competitive in the long run.

Aside those very well established players that primarily have the benefit of abundant liquidity and big user bases, Initia will also face competition from other L1s that look to provide a basis for scalable L2s.

Along the before-mentioned Dymension and Saga, there is also @AstriaOrg, which is building a similar (based) rollup ecosystem on Celestia.

However, Initia's journey (incl. the hugely successful testnet) is very impressive so far.

As the @CelestiaOrg ecosystem enters its next phase of growth, Initia could very well find its place as the primary framework for launching and coordinating Celestia-based app-chains.

With mainnet expected to launch in October, it will be exciting to see how well Initia will be able to establish itself in the market.

⚠️ This is not financial advice and the report is NOT sponsored by any third-party.

61.63K

96

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.