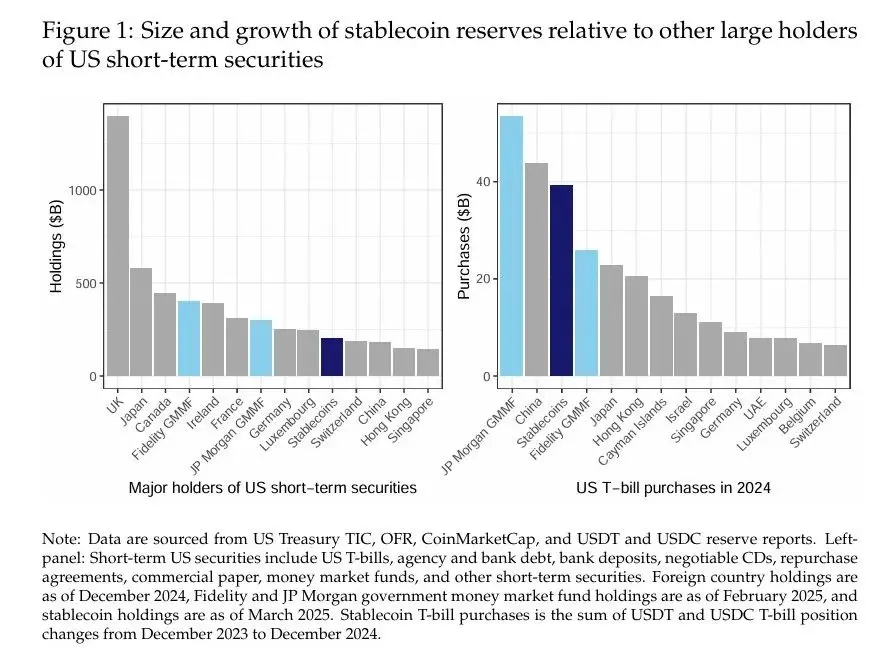

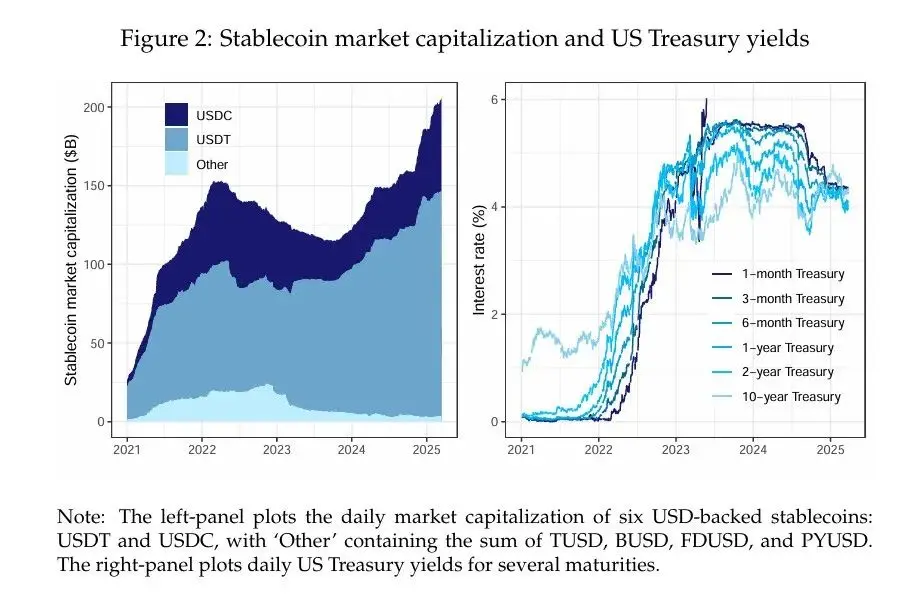

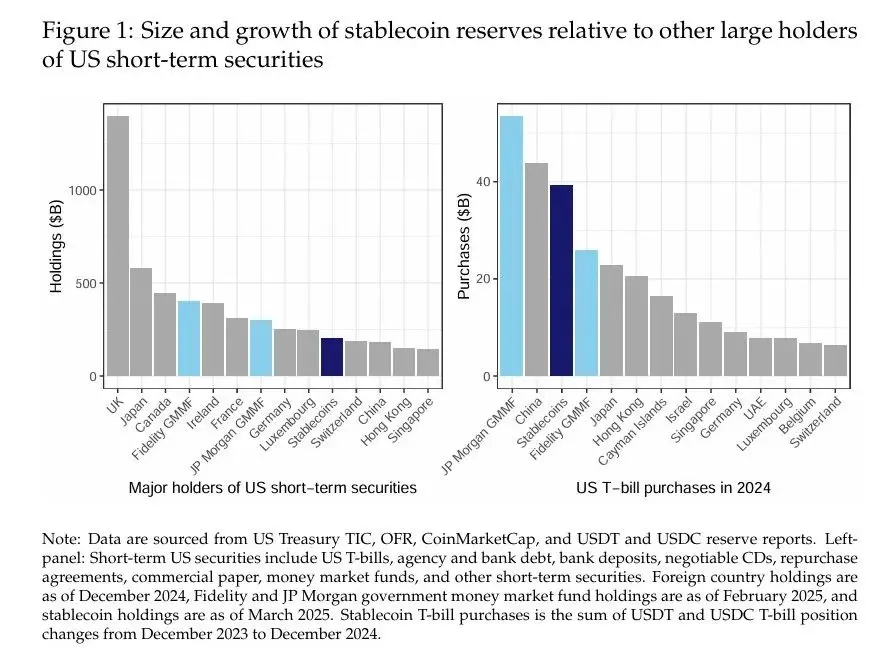

Authors: Rashad Ahmed and Iñaki Aldasoro Compilation: Institute of Fintech Research, University of Chinese Dollar-backed stablecoins have experienced significant growth and are poised to reshape financial markets. As of March 2025, the total AUM of these cryptocurrencies, which are committed to being denominated against the U.S. dollar and backed by dollar-denominated assets, exceeded $200 billion, more than short-term U.S. securities held by major foreign investors such as China (Figure 1, left). Stablecoin issuers, notably Tether (USDT) and Circle (USDC), primarily support their tokens through U.S. short-term Treasury bonds (T-bills) and money market instruments, making them significant players in the short-term debt market. In fact, dollar-backed stablecoins bought nearly $40 billion of short-term U.S. Treasuries in 2024, the size of the largest U.S. government money market fund, and more than most foreign investors bought (Figure 1, right). Although previous studies have focused on the role of stablecoins in cryptocurrency volatility (Griffin and Shams, 2020), their impact on commercial paper markets (Barthelemy et al., 2023), or their systemic risk (Bullmann et al., 2019), their interaction with traditional safe asset markets remains underexplored.  This paper examines whether stablecoin flows exert measurable demand pressure on US Treasury yields. We documented two key findings. First, stablecoin flows have depressed short-term Treasury yields in a manner comparable to the impact of small-scale QE on long-term yields. In our most stringent specification, overcoming the endogeneity problem by using a series of crypto shocks that affect stablecoin flows but do not directly affect Treasury yields, we found that a $3.5 billion 5-day stablecoin inflow (i.e., 2 standard deviations) would reduce the 3-month Treasury yield by about 2-2.5 basis points (bps) in 10 days. Second, we break down the yield impact into issuer-specific contributions and find that USDT contributed the most to Treasury yield depression, followed by USDC. We discuss the policy implications of these findings for monetary policy transmission, stablecoin reserve transparency, and financial stability. Our empirical analysis is based on daily data from January 2021 to March 2025. To construct a measure of stablecoin flows, we collected market cap data for the six largest USD-backed stablecoins and aggregated them into a single number. We then use the 5-day change in the total market capitalization of the stablecoin as a proxy indicator for stablecoin inflows. We collected data on the U.S. Treasury yield curve as well as cryptocurrency prices (Bitcoin and Ethereum). We chose the 3-month Treasury yield as the outcome variable we are interested in, as the largest stablecoins have disclosed or publicly stated this maturity as their preferred investment maturity. A simple univariate local projection that correlates the change in the 3-month Treasury yield with the 5-day stablecoin flow can be subject to significant endogenous biases. In fact, this "naïve" normative estimate suggests that the $3.5 billion stablecoin inflow correlates with a 3-month Treasury yield falling by as much as 25 basis points in 30 days. The magnitude of this effect is incredibly large, as it suggests that the impact of a 2-standard-deviation stablecoin inflow on short-term interest rates is similar to that of a cut in the Fed's policy rate. We believe that these large estimates can be explained by the presence of endogeneity that skews the estimates downwards (i.e., negative estimates that are larger relative to the true effect) due to missing variable bias (because potential confounders are not controlled) and simultaneity bias (because Treasury yields may affect stablecoin liquidity). To overcome the endogeneity problem, we first extend the local projection specification to control the Treasury yield curve as well as crypto asset prices. These control variables are divided into two groups. The first group includes the forward change in the yield of US Treasury bonds of all maturities other than 3 months (from t to t+h). We control the evolution of the forward Treasury yield curve to isolate the conditional impact of stablecoin flows on the 3-month yield based on changes in yields of neighboring maturities over the same local projected maturities. The second set of control variables includes Treasury yields and cryptoasset prices with a 5-day change (from T-5 to T) to control for various financial and macroeconomic conditions that may be associated with stablecoin flows. With the introduction of these control variables, local projections estimate that Treasury yields fell by 2.5 to 5 basis points after the $3.5 billion stablecoin inflow. These estimates are statistically significant, but nearly an order of magnitude smaller than the "naïve" estimates. The attenuation of the estimates is consistent with what we would expect from the endogenous bias signs. In the third specification, we further strengthen the identification through the Instrumental Variable (IV) strategy. According to the methodology of Aldasoro et al. (2025), we instrumentalize 5-day stablecoin flows with a series of crypto shocks that are built on the unpredictable components of the Bloomberg Galaxy Crypto Index. We use the accumulation sum of crypto shock sequences as instrumental variables to capture the special but persistent nature of crypto market booms and busts. The first-stage regression of 5-day stablecoin flows to cumulative crypto shocks satisfies the correlation condition and shows that stablecoins tend to have significant inflows during crypto market booms. We believe the exclusion restriction is satisfied, as the particular crypto boom is isolated enough not to have a meaningful impact on Treasury market pricing – unless through inflows into stablecoins, issuers use those funds to buy Treasury bonds. Our IV estimate suggests that a $3.5 billion stablecoin inflow would reduce the 3-month Treasury yield by 2-2.5 basis points. These results are robust for changing the set of control variables by focusing on maturities that have a low correlation with the 3-month yield – if any, the results are slightly stronger in number. In the additional analysis, we did not find a spillover effect of stablecoin purchases on longer maturities such as 2-year and 5-year maturities, although we did find limited spillovers in the 10-year maturities. In principle, the effects of inflows and outflows may be asymmetrical, as the former allows the issuer a certain amount of discretion in the timing of purchases, which does not exist when market conditions are tight. When we allow estimates to vary under inflow and outflow conditions, we do find that the impact of outflows on yields is quantitatively greater than that of inflows (+6-8 bps vs. -3bps, respectively). Finally, based on our IV strategy and baseline specifications, we also break down the estimated yield impact of stablecoin flows into issuer-specific contributions. We found that USDT flows contributed the most on average at around 70%, while USDC flows contributed about 19% to the impact of estimated yields. Other stablecoin issuers contributed the rest (about 11%). These contributions are qualitatively proportional to the size of the issuer. Our findings have important policy implications, especially if the stablecoin market continues to grow. With regard to monetary policy, our yield impact estimates suggest that if the stablecoin industry continues to grow rapidly, it could eventually affect the transmission of monetary policy to Treasury yields. The growing influence of stablecoins in the Treasury market may also lead to the scarcity of safe assets for non-bank financial institutions, which could impact liquidity premiums. With regard to stablecoin regulation, our results highlight the importance of transparent reserve disclosure in order to effectively monitor a centralized portfolio of stablecoin reserves. When stablecoins become large investors in the Treasury market, there can be potential financial stability implications. On the one hand, it exposes the market to the risk of a sell-off that could occur in the event of a run on major stablecoins. In fact, our estimates suggest that this asymmetric effect is already measurable. Our estimates may be the lower bound of the potential selling effect, as they are based on a sample that is primarily based on growth markets and therefore may underestimate the potential for nonlinear effects under severe pressure. In addition, stablecoins themselves may facilitate arbitrage strategies, such as Treasury basis trading, through investments such as reverse repo agreements backed by Treasury collateral, which is a primary concern for regulators. Equity and liquidity buffers may mitigate some of these financial stability risks. Our analysis is based on daily data from January 2021 to March 2025. First, we collected market cap data from CoinMarketCap for six USD-backed stablecoins: USDT, USDC, TUSD, BUSD, FDUSD, and PYUSD. We aggregate the data of these stablecoins to get a metric that measures the total market capitalization of the stablecoins, and then calculate their 5-day change. We have collected the daily prices of Bitcoin and Ethereum, the two largest cryptocurrencies, through Yahoo Finance. We obtained the daily series of the US Treasury yield curve from FRED. We considered the following terms: 1 month, 3 months, 6 months, 1 year, 2 years, and 10 years. As part of our identification strategy, we also used a daily version of the crypto-shock sequence proposed by Aldasoro et al. (2025). Crypto shocks are calculated as an unpredictable component of the Bloomberg Galaxy Crypto Index (BGCI), which captures a broad range of crypto market dynamics (we'll provide more details on crypto shocks below). Figure 2 shows the market capitalization and U.S. Treasury yields of USD-backed stablecoins over the sample period. Stablecoin market capitalization has been rising since the second half of 2023, with significant growth in early and late 2024. The industry is highly concentrated. The two largest stablecoins (USDT and USDC) account for more than 95% of the outstanding amount. Treasury yields in our sample cover both the rate hike cycle and the pause and subsequent easing cycle that begins around mid-2024. The sample period also includes a period of significant curve reversal, most notably the dark blue line moving from the bottom to the top of the yield curve.

This paper examines whether stablecoin flows exert measurable demand pressure on US Treasury yields. We documented two key findings. First, stablecoin flows have depressed short-term Treasury yields in a manner comparable to the impact of small-scale QE on long-term yields. In our most stringent specification, overcoming the endogeneity problem by using a series of crypto shocks that affect stablecoin flows but do not directly affect Treasury yields, we found that a $3.5 billion 5-day stablecoin inflow (i.e., 2 standard deviations) would reduce the 3-month Treasury yield by about 2-2.5 basis points (bps) in 10 days. Second, we break down the yield impact into issuer-specific contributions and find that USDT contributed the most to Treasury yield depression, followed by USDC. We discuss the policy implications of these findings for monetary policy transmission, stablecoin reserve transparency, and financial stability. Our empirical analysis is based on daily data from January 2021 to March 2025. To construct a measure of stablecoin flows, we collected market cap data for the six largest USD-backed stablecoins and aggregated them into a single number. We then use the 5-day change in the total market capitalization of the stablecoin as a proxy indicator for stablecoin inflows. We collected data on the U.S. Treasury yield curve as well as cryptocurrency prices (Bitcoin and Ethereum). We chose the 3-month Treasury yield as the outcome variable we are interested in, as the largest stablecoins have disclosed or publicly stated this maturity as their preferred investment maturity. A simple univariate local projection that correlates the change in the 3-month Treasury yield with the 5-day stablecoin flow can be subject to significant endogenous biases. In fact, this "naïve" normative estimate suggests that the $3.5 billion stablecoin inflow correlates with a 3-month Treasury yield falling by as much as 25 basis points in 30 days. The magnitude of this effect is incredibly large, as it suggests that the impact of a 2-standard-deviation stablecoin inflow on short-term interest rates is similar to that of a cut in the Fed's policy rate. We believe that these large estimates can be explained by the presence of endogeneity that skews the estimates downwards (i.e., negative estimates that are larger relative to the true effect) due to missing variable bias (because potential confounders are not controlled) and simultaneity bias (because Treasury yields may affect stablecoin liquidity). To overcome the endogeneity problem, we first extend the local projection specification to control the Treasury yield curve as well as crypto asset prices. These control variables are divided into two groups. The first group includes the forward change in the yield of US Treasury bonds of all maturities other than 3 months (from t to t+h). We control the evolution of the forward Treasury yield curve to isolate the conditional impact of stablecoin flows on the 3-month yield based on changes in yields of neighboring maturities over the same local projected maturities. The second set of control variables includes Treasury yields and cryptoasset prices with a 5-day change (from T-5 to T) to control for various financial and macroeconomic conditions that may be associated with stablecoin flows. With the introduction of these control variables, local projections estimate that Treasury yields fell by 2.5 to 5 basis points after the $3.5 billion stablecoin inflow. These estimates are statistically significant, but nearly an order of magnitude smaller than the "naïve" estimates. The attenuation of the estimates is consistent with what we would expect from the endogenous bias signs. In the third specification, we further strengthen the identification through the Instrumental Variable (IV) strategy. According to the methodology of Aldasoro et al. (2025), we instrumentalize 5-day stablecoin flows with a series of crypto shocks that are built on the unpredictable components of the Bloomberg Galaxy Crypto Index. We use the accumulation sum of crypto shock sequences as instrumental variables to capture the special but persistent nature of crypto market booms and busts. The first-stage regression of 5-day stablecoin flows to cumulative crypto shocks satisfies the correlation condition and shows that stablecoins tend to have significant inflows during crypto market booms. We believe the exclusion restriction is satisfied, as the particular crypto boom is isolated enough not to have a meaningful impact on Treasury market pricing – unless through inflows into stablecoins, issuers use those funds to buy Treasury bonds. Our IV estimate suggests that a $3.5 billion stablecoin inflow would reduce the 3-month Treasury yield by 2-2.5 basis points. These results are robust for changing the set of control variables by focusing on maturities that have a low correlation with the 3-month yield – if any, the results are slightly stronger in number. In the additional analysis, we did not find a spillover effect of stablecoin purchases on longer maturities such as 2-year and 5-year maturities, although we did find limited spillovers in the 10-year maturities. In principle, the effects of inflows and outflows may be asymmetrical, as the former allows the issuer a certain amount of discretion in the timing of purchases, which does not exist when market conditions are tight. When we allow estimates to vary under inflow and outflow conditions, we do find that the impact of outflows on yields is quantitatively greater than that of inflows (+6-8 bps vs. -3bps, respectively). Finally, based on our IV strategy and baseline specifications, we also break down the estimated yield impact of stablecoin flows into issuer-specific contributions. We found that USDT flows contributed the most on average at around 70%, while USDC flows contributed about 19% to the impact of estimated yields. Other stablecoin issuers contributed the rest (about 11%). These contributions are qualitatively proportional to the size of the issuer. Our findings have important policy implications, especially if the stablecoin market continues to grow. With regard to monetary policy, our yield impact estimates suggest that if the stablecoin industry continues to grow rapidly, it could eventually affect the transmission of monetary policy to Treasury yields. The growing influence of stablecoins in the Treasury market may also lead to the scarcity of safe assets for non-bank financial institutions, which could impact liquidity premiums. With regard to stablecoin regulation, our results highlight the importance of transparent reserve disclosure in order to effectively monitor a centralized portfolio of stablecoin reserves. When stablecoins become large investors in the Treasury market, there can be potential financial stability implications. On the one hand, it exposes the market to the risk of a sell-off that could occur in the event of a run on major stablecoins. In fact, our estimates suggest that this asymmetric effect is already measurable. Our estimates may be the lower bound of the potential selling effect, as they are based on a sample that is primarily based on growth markets and therefore may underestimate the potential for nonlinear effects under severe pressure. In addition, stablecoins themselves may facilitate arbitrage strategies, such as Treasury basis trading, through investments such as reverse repo agreements backed by Treasury collateral, which is a primary concern for regulators. Equity and liquidity buffers may mitigate some of these financial stability risks. Our analysis is based on daily data from January 2021 to March 2025. First, we collected market cap data from CoinMarketCap for six USD-backed stablecoins: USDT, USDC, TUSD, BUSD, FDUSD, and PYUSD. We aggregate the data of these stablecoins to get a metric that measures the total market capitalization of the stablecoins, and then calculate their 5-day change. We have collected the daily prices of Bitcoin and Ethereum, the two largest cryptocurrencies, through Yahoo Finance. We obtained the daily series of the US Treasury yield curve from FRED. We considered the following terms: 1 month, 3 months, 6 months, 1 year, 2 years, and 10 years. As part of our identification strategy, we also used a daily version of the crypto-shock sequence proposed by Aldasoro et al. (2025). Crypto shocks are calculated as an unpredictable component of the Bloomberg Galaxy Crypto Index (BGCI), which captures a broad range of crypto market dynamics (we'll provide more details on crypto shocks below). Figure 2 shows the market capitalization and U.S. Treasury yields of USD-backed stablecoins over the sample period. Stablecoin market capitalization has been rising since the second half of 2023, with significant growth in early and late 2024. The industry is highly concentrated. The two largest stablecoins (USDT and USDC) account for more than 95% of the outstanding amount. Treasury yields in our sample cover both the rate hike cycle and the pause and subsequent easing cycle that begins around mid-2024. The sample period also includes a period of significant curve reversal, most notably the dark blue line moving from the bottom to the top of the yield curve. Conclusion and Implications

Scale. It is estimated that the yield impact of 2 to 2.5 basis points comes from $3.5 billion (or 2 standard deviations) of stablecoin inflows, which by the end of 2024, the The size of the industry is about $200 billion. As the stablecoin industry continues to grow, it is not unreasonable to expect its footprint in the Treasury market to increase as well. Assuming that by 2028, the stablecoin industry grows 10-fold to $2 trillion, the difference in 5-day traffic increases proportionally. The 2 standard deviation flow would then reach about $11 billion, with an estimated impact of -6.28 to 7.85 basis points on Treasury yields. These estimates suggest that the growing stablecoin industry may eventually dampen short-term yields, completely affecting the transmission of the Fed's monetary policy to market yields. Mechanism. There are at least three channels for stablecoins to influence pricing in the Treasury market. The first is through direct demand, as the purchase of stablecoins reduces the available supply of paper money, as long as the money flowing into the stablecoin does not flow into treasury bills. The second channel is indirect, as stablecoin demand for U.S. Treasuries could ease traders' balance sheet constraints. This, in turn, will affect asset prices, as this will reduce the supply of Treasuries that traders need to absorb. The third channel is through the signal effect, as large inflows can become a signal of institutional risk appetite or lack thereof, which investors then incorporate into the market. Policy implications. Policies around reserve transparency will interact with the growing footprint of stablecoins in the Treasury market. For example, USDC's fine-grained reserve disclosures improve market predictability, while USDT's opacity complicates analysis. Regulatory requirements for standardized reporting could mitigate the systemic risk posed by the centralized ownership of government bonds by making some of these flows more transparent and predictable. While the stablecoin market is still relatively small, stablecoin issuers are already a meaningful player in the Treasury market, and our findings suggest that yields are already having some impact at this early stage. Monetary policy will also interact with the role of stablecoins as investors in the Treasury market. For example, in a situation where stablecoins become very large, stablecoin-driven yield compression could weaken the Fed's control over short-term interest rates, which may require coordinated monetary policy among regulators to effectively influence financial conditions. This view is not just theoretical – for example, the "green dilemma" of the early 21st century stems from the fact that the Fed's monetary policy did not have the desired impact on long-term Treasury yields. At the time, this was largely due to the huge demand for U.S. Treasuries from foreign investors, which affected pricing in the U.S. Treasury market.

Finally, stablecoins become investors in the Treasury market, which has a clear impact on financial stability. As discussed in the literature on stablecoins, they are still functional, and their balance sheets are subject to liquidity and interest rate risk, as well as some credit risk. Therefore, if a major stablecoin comes under severe redemption pressure, especially given the lack of a discount window or lender of last resort, a concentrated position in Treasury bills could expose the market to a sell-off, especially those that will not mature immediately. The evidence we provide on the asymmetric effect suggests that stablecoins may have a greater impact on the Treasury market in an environment characterized by large and sharp outflows. In this regard, the magnitudes suggested by our estimates may be a lower bound, as they are based on a sample that primarily includes a growing market. This is likely to change as the stablecoin industry grows, exacerbating concerns about the stability of the Treasury market.

Limit. Our analysis provides some preliminary evidence of the emerging footprint of stablecoins in the Treasury market. However, our results should be interpreted with caution. First of all, we face data constraints in our analysis, as the USDT reserve portfolio is incompletely disclosed in its expiration date, which complicates identification. Therefore, we must assume which Treasury bill maturity is most likely to be affected by stablecoin flows. Second, we control volatility in financial markets by including Bitcoin and Ether returns, as well as changes in yields on various Treasury maturities. However, these variables may not fully capture the risk sentiment and macroeconomic conditions that collectively affect stablecoin flows and Treasury yields. We tried to solve this problem with a tool variable strategy, but we realized that our tool variables themselves may be limited, including misspecifications in our local project model. In addition, due to data constraints and the high concentration of the stablecoin industry, our estimates rely almost entirely on time series variations, as the cross-section is too limited to be exploited in any meaningful way.

All in all, stablecoins have become significant players in the Treasury market, having a measurably significant impact on short-term yields. Their growth blurs the lines between cryptocurrencies and traditional finance, requiring regulators to focus on how they are reserved, the potential impact on monetary policy transmission, and financial stability risks. Future research could explore cross-border spillovers and interactions with money market funds, particularly during liquidity crises.