The most hated ETH rally is already happening.

No one’s paying attention.

No one’s talking about it.

But the signs are all there.

Let me walk you through why Ethereum might hit a new ATH when everyone least expects it:

🧵👇

1/

Ethereum’s quiet accumulation phase

While the world focuses on #Bitcoin, Ethereum has been steadily setting up for a massive run.

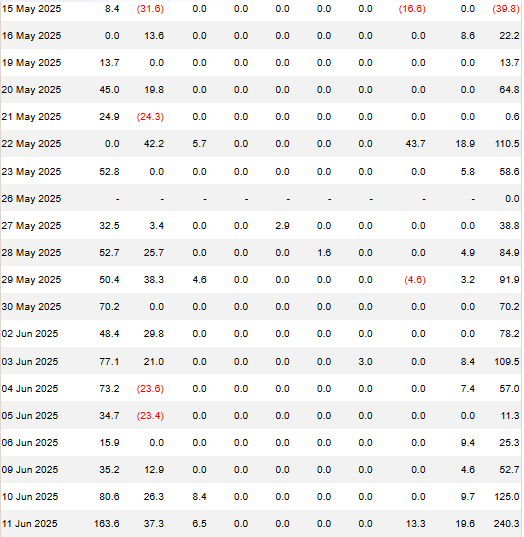

For 18 straight days, $ETH has seen inflows, with $240M flowing in on June 11 alone.

2/

BlackRock and institutional confidence

The real story is in the institutional capital.

BlackRock, for example, hasn't sold a single ETH since May 8.

In total, over $1 billion worth of ETH has been added to their portfolio since May 8.

This isn’t speculative money.

This is the world's largest asset manager loading up.

3/

$ETH is rising up slowly and gaining market share.

ETH’s market share in the overall crypto space has quietly risen to 10%, after bottoming out in Q2 2025.

Last time ETH dominance was at this level, it nearly doubled in a year.

4/

Supply dynamics: The hidden driver

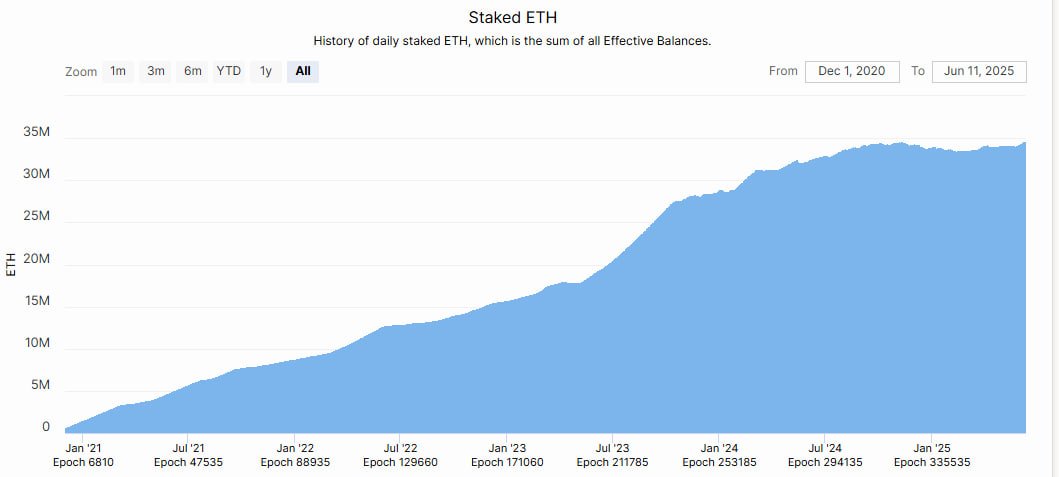

The amount of ETH being staked continues to rise—34.7 million ETH are now locked up, which is 29% of the total supply.

On top of that, over 140K ETH (~$393M) just left exchanges in a single day.

Fewer ETH available for sale means less liquidity and higher potential for price increases when demand starts to rise.

5/

The narrative of low network activity is changing

There’s been a lot of talk about Ethereum’s network activity being “low.”

But what’s happening is a shift in usage patterns.

• Layer 2 solutions like Arbitrum, Optimism, and Base are helping alleviate pressure on the main chain.

• Gas fees are now lower, which is attracting more users.

• The Pectra upgrade has made ETH more scalable and efficient, boosting network activity again.

ETH burn is picking up too, which could put upward pressure on price as fewer ETH tokens are circulating.

6/

ETH vs BTC: The subtle shift

Bitcoin might be the king, but ETH is quietly outperforming.

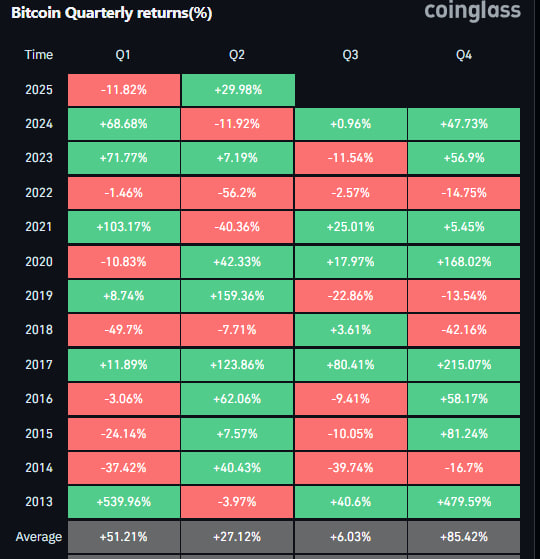

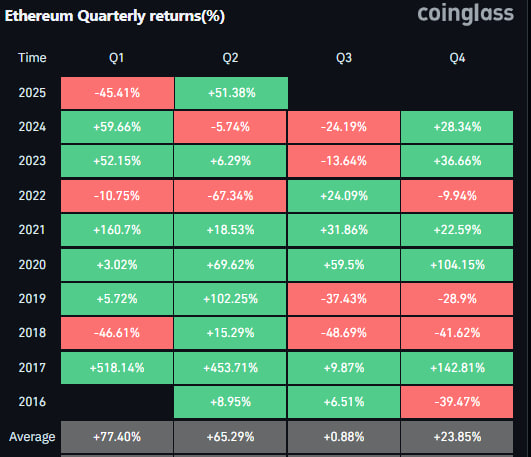

• ETH is up 51% in Q2 2025, while BTC is only up 30%.

• The ETH/BTC ratio is trending upwards, signaling that institutional investors are starting to see more value in Ethereum than in Bitcoin.

7/

Futures and options are showing real conviction.

ETH futures open interest just topped $20B—a record high. This signals that traders are building serious positions.

The market is betting on a rise.

Options market skew is heavily weighted toward calls, which is another indicator that traders expect higher ETH prices in the short-to-medium term.

8/

BTC dominance may have peaked

While $BTC has historically been the go-to for institutional investors, the narrative is shifting.

Institutions are starting to look at Ethereum more closely.

ETH’s ability to integrate with DeFi, NFTs, stablecoins, and even enterprise solutions like JPMorgan’s Onyx is making it a more attractive long-term investment.

This isn’t a flash in the pan, ETH is becoming an integral part of the broader digital economy.

9/

Macro environment: Ethereum’s perfect timing

The regulatory environment for crypto is starting to clear up.

With stablecoin regulation advancing and blockchain adoption becoming more mainstream, Ethereum is in the right place at the right time.

It’s not just about price movements, it’s about positioning ETH as a core asset for the next wave of institutional and retail adoption.

10/

It’s not about hype; it’s about structure

One of the best parts about this cycle for Ethereum is that there is no hype.

No “ETH to $10K tomorrow” claims.

This is not a “pump-and-dump” rally.

It’s a sustainable, structural shift where demand is increasing.

11/

What’s next for Ethereum?

ETH isn’t just looking for short-term price appreciation. It’s building a long-term position.

Here’s what could happen next:

• Continuous ETF inflows—as more institutional investors enter the space.

• More ETH being staked—reducing circulating supply and increasing scarcity.

• Layer 2s will continue to drive adoption and usage.

If these trends continue, $ETH could hit $6k-$8k by the end of 2025.

12/

Don’t sleep on ETH this cycle.

This isn’t the "big run" everyone expects. It’s the slow grind to $10K.

The one you didn’t see coming.

By the time the mainstream catches on, ETH will already be well on its way to a new ATH.

The moves are already happening, it's just happening quietly, away from the spotlight.

Conclusion

ETH is becoming a real contender, not just in crypto, but in the broader financial ecosystem.

With institutional flows, network upgrades, and increasing use cases, Ethereum is positioning itself for a breakout.

The bull market is already starting, and it’s only a matter of time before ETH hits new highs.

That's the wrap!

If you find this thread valuable.

➡️ Hit like ❤️

➡️ Repost it

➡️ Bookmark it

Follow me at @AltCryptoGems for more quality crypto content.

948

100.98K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.