DeFi is stagnant.

The RWA sector is keeping crypto alive.

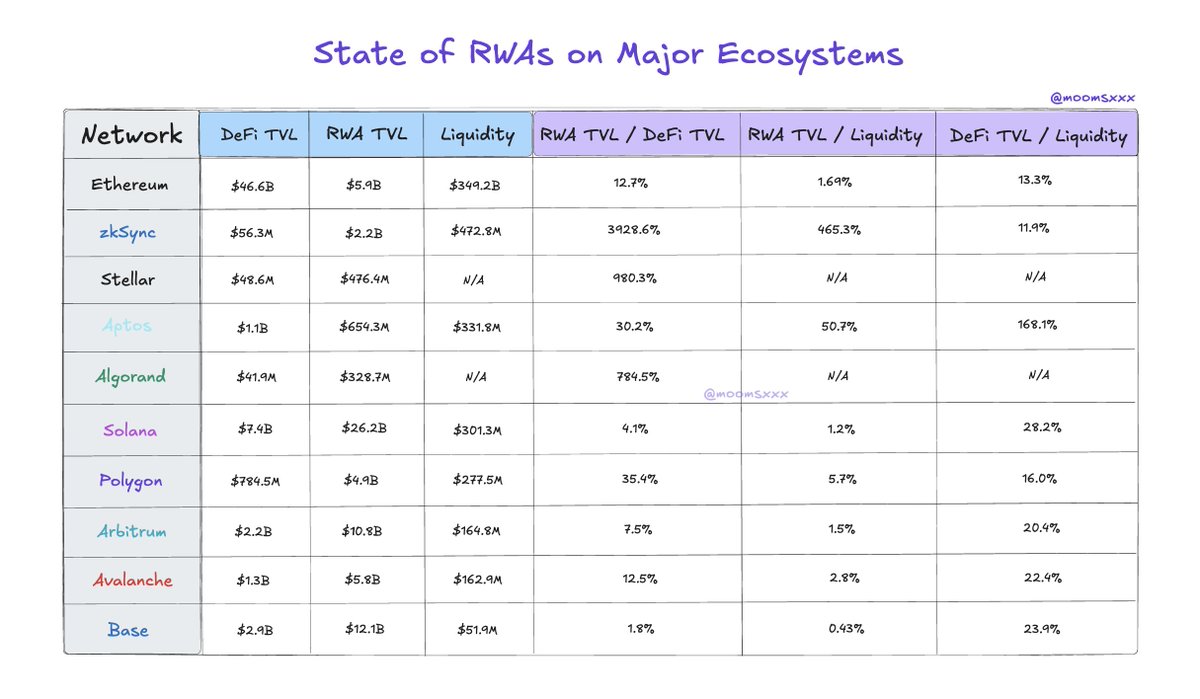

Over the past year, the RWA sector has grown by an impressive 695%, while DeFi has remained largely stagnant, growing by only 3.4%.

According to data from @RWA_xyz, 10 ecosystems now boast over $50 million in tokenized assets, a clear sign of growing institutional adoption.

In this piece, we’ll dive into these ecosystems, comparing their RWA vertical to their broader DeFi activity and liquidity, to understand where the RWA sector is gaining momentum and where it’s most likely to thrive.

We’ll go in order based on the RWA total value per chain, from the largest to the smallest.

1.) @ethereum

1st by the total amount of tokenized assets, with $5.98 billion, Ethereum L1 holds 56.8% of the total RWA market share.

Furthermore, although we won’t dive into this in detail here, it’s worth highlighting that 54.8% of the total stablecoin market cap is held on Ethereum L1, followed by Tron with 29.9% and Solana with 5.5% market share.

📊 TVL BREAKDOWN

DeFi TVL - $46.6B

Bridged TVL - $349.2B

RWA TVL - $5.9B

📋 KEY RATIOS

RWA TVL / DeFi TVL - 12.7%

With this ratio, we're analyzing how much of the chain’s DeFi activity is made up of RWAs.

RWA TVL / Bridged TVL - 1.69%

This ratio helps us understand how much of the total bridged liquidity on the chain is actually flowing into RWAs.

A low ratio implies there's untapped demand and idle capital that could be directed toward real-world assets. On the other hand, a high ratio indicates the chain is effective at capturing value and directing it into RWAs.

You could also think of this as capital efficiency for RWA adoption.

In Ethereum's case, it's clear there is a lot of capital waiting to be unlocked.

DeFi TVL / Bridged TVL - 13.3%

Using the same logic, we can apply the previous metric to DeFi and observe that a larger share of bridged liquidity is actively utilized within DeFi protocols compared to RWAs. This ultimately indicates higher composability and more “productive” capital across DeFi than in the RWA sector.

While there’s still plenty of room for growth, when we compare the growth of DeFi and RWA on Ethereum since the 2022 bottom, the trend is clear.

From Nov 21, 2022, to Apr 21, 2025:

• DeFi TVL grew by 100.5%

• RWA TVL grew by 486.2%

🏛️ INSTITUTIONAL PRESENCE IN THE ECOSYSTEM

8 out of 17 institutional funds are currently deployed on Ethereum, with 7 of these managed by @Securitize and the other by @superstatefunds.

Furthermore, the two largest gold-backed tokens, $PAXG and $XAUT, are also issued on Ethereum.

So far, despite the critiques around Ethereum’s tech stack, institutions continue to favor it over any other chain, and that trend doesn’t seem to be slowing down anytime soon.

🧱 BENEFITS OF TOKENIZING ASSETS ON ETHEREUM

• Deep Liquidity - High potential to find demand for your assets

• Composability - Opportunity to launch new products and features thanks to the vibrant DeFi ecosystem

• Reliability & Security - Established chain with no history of security or reliability issues and secured by over $50B worth of capital.

2.) @zksync

2nd by RWA Total Value, zkSync saw a 10x increase in this metric in late February, thanks to the launch of @tradable_xyz, a private credit protocol that currently has over $2B in active loans.

📊 TVL BREAKDOWN

DeFi TVL - $56.3M

Bridged TVL - $472.8M

RWA TVL - $2.2B

📋 KEY RATIOS

RWA TVL / DeFi TVL - 3928.6%

This ratio is notably high, indicating a less developed DeFi ecosystem compared to the significant amount of RWAs on the chain, although most come from a single protocol.

RWA TVL / Bridged TVL - 465.3%

This ratio is also quite high and can be interpreted in two ways: either there’s a low amount of liquidity on the chain, or RWAs are already tapping into most of the existing demand, with little room for growth.

DeFi TVL / Bridged TVL - 11.9%

Looking at this ratio, we see it’s quite similar to Ethereum.

However, it’s important to note that the $2B total value coming from Tradable significantly inflates these metrics, which might not give a proper picture of zkSync’s situation.

If we exclude Tradable’s $2B from the equation, zkSync's RWA total value is ~$191M. This gives us:

RWA TVL / DeFi TVL - 241%

RWA TVL / Bridged TVL - 40%

These adjusted ratios show that the RWA sector is more developed than the DeFi one, and a significant share of “active” liquidity is being directed toward RWAs.

🧱 BENEFITS OF TOKENIZING ASSETS ON ZKSYNC

• Ability to launch your own elastic ZK chain

• Interoperability between ZK chains

ZKSync's tech stack is among the most advanced in the space. The ability for institutions to launch their zk-powered chain is still massively overlooked.

We could see a future in which two banks each operate their own ZK chain while being able to share data and capital from one to another, preserving confidentiality about the value of such transfers.

Privacy enabled by ZK tech is already being explored by players like @DeutscheBank, @sygnumofficial, and @UBS.

Wouldn’t be surprised to see more institutions join the ecosystem soon.

3.) @StellarOrg

3rd by RWA total value, Stellar has built strong ties with enterprises, TradFi institutions, and governments—thanks to its focus on low-cost cross-border payments and asset issuance.

📊 TVL BREAKDOWN

DeFi TVL – $48.6M

RWA TVL – $476.4M

📋 KEY RATIOS

RWA TVL / DeFi TVL – 980.3%

This massive ratio says it all: tokenized assets on Stellar are nearly 10x larger than its DeFi ecosystem.

The majority of Stellar’s tokenized assets come from $BENJI, @FTI_US's onchain fund focused on U.S. Treasuries, which accounts for 98% of RWA's TVL on Stellar.

Note also how @WisdomTreeFunds launched its gold-backed token $WTGOLD on Stellar, but with just $1M of market cap, the traction stays low for now.

🧱 BENEFITS OF TOKENIZING ASSETS ON STELLAR

1.) The chain is known for enabling permissioned DeFi or "semi-private" markets, which is highly valued by tradFi entities.

2.) At the same time, it has a strong record of working with established enterprises such as @MoneyGram, @circle, @veloprotocol, and others.

Overall, Stellar is less focused on DeFi composability and more on FX/remittance rails and infrastructure which institutions are already familiar with.

4.) @Aptos

Aptos has been one of the fastest-growing chains in terms of TVL over the past 6 months. A good part of that growth came from RWAs, which spiked by 50%.

📊 TVL BREAKDOWN

DeFi TVL - $1.1B

Bridged TVL - $654.3M

RWA TVL - $331.8M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 30.2%

RWA TVL / Bridged TVL - 50.7%

DeFi TVL / Bridged TVL - 168.1%

The fact that tokenized assets account for nearly 30% of DeFi activity on a chain with $1B in TVL indicates strong traction in the RWA ecosystem.

This is more evident when looking at the amount of tradFi players building on Aptos. Here’s what its RWA TVL looks like:

@pactconsortium's active loans - $219M

$BUIDL by Blackrock - $53M

$BENJI by Franklin Templeton - $22M

@librecap's three onchain funds - $20M

$ACRED by Securitize - $10M

$USDY by Ondo - $7M

Also worth noting Aptos is the second largest chain for $BUIDL after Ethereum.

🧱 BENEFITS OF TOKENIZING ASSETS ON APTOS

1.) Aptos uses Move instead of Solidity.

This makes it extremely safe for financial applications, where you don’t want exploits like re-entrancy bugs or overflow errors.

2.) Although I'm trying to focus as little as possible on the tech, Aptos processed 326 million transactions in a single day without failures, delays, or gas fee spikes in August 2024.

I believe these two reasons are why the chain is appealing to TradFi engineers.

5.) @Algorand

📊 TVL BREAKDOWN

DeFi TVL - $41.9M

RWA TVL - $328.7M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 784.5%

I see Algorand in a similar position to Stellar. Rather than pushing hard into DeFi, the chain focuses on collaborations with enterprises and governments such as @FIFAcom, @bancaditalia, @UN, and others.

Currently, 100% of its RWA total value comes from @exodus tokenized shares.

It's interesting how @Securitize is once again the infrastructure partner handling the issuance and backend of the product.

🧱 BENEFITS OF TOKENIZING ASSETS ON ALGORAND

1.) One of the main advantages of tokenizing on Algorand lies in its strong relationships with governments and central banks, especially across Europe.

2.) At the same time, Algorand uses Algorand Standard Assets (ASAs), a native tokenization standard that simplifies the process for developers to launch tokenized products.

A good example is ZTLment, a European fintech company that migrated from Ethereum to Algorand. At ETHDenver they explained how Algorand’s built-in features, like Atomic Transactions and multisig approvals, helped them reduce by a lot the need for custom development.

6.) @solana

Surprisingly, Solana ranks 6th by RWA total value on the chain.

📊 TVL BREAKDOWN

DeFi TVL - $7.4B

Bridged TVL - $26.2B

RWA TVL - $301.3M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 4.1%

RWA TVL / Bridged TVL - 1.2%

DeFi TVL / Bridged TVL - 28.2%

As expected, Solana shows a more developed DeFi ecosystem compared to most chains we've discussed so far, which results in lower ratios across the first two metrics.

Taking into account Ethereum and Aptos, the only two chains with $1B+ of TVL already mentioned, Solana's RWA ecosystem appears less developed for a network of its size.

Going more in-depth, the RWA total value is spread like this:

$USDY by Ondo - $173M

$OUSG by Ondo - $79M

$ACRED by @apolloglobal - $25M

$BUIDL by Blackrock - $20M

@librecap's funds - ~$4M

🧱 BENEFITS OF TOKENIZING ASSETS ON SOLANA

1.) Solana has the most vibrant DeFi ecosystem after Ethereum, offering high composability for institutions looking to explore new use cases for their tokenized assets.

2.) Like Aptos, Solana provides high transaction speeds and lower costs, making it ideal for high-volume trades.

Additionally, Solana's dev community and ecosystem initiatives (such as @superteam across various regions) are rapidly growing, with increasing resources and support for developers.

7.) @0xPolygon

📊 TVL BREAKDOWN

DeFi TVL - $784.5M

Bridged TVL - $4.9B

RWA TVL - $277.5M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 35.4%

RWA TVL / Bridged TVL - 5.7%

DeFi TVL / Bridged TVL - 16.0%

What stands out with Polygon is its relatively well-developed RWA ecosystem compared to its DeFi one, but with more room for growth due to untapped liquidity.

In the case of Polygon, a significant portion of the RWA total value comes from treasury bills, but this time, not just U.S. ones.

• $110M (40% of the total value) comes from $EUTBL, European T-bills by @Spiko_finance.

• An additional $17M comes from Spiko’s tokenized U.S. T-bills.

The other half of the chain's RWA ecosystem is composed of:

• $65M split evenly across $BENJI and $BUIDL

• $15M from two @hamilton_lane's funds

• The remaining $67M from @MercadoBitcoin's active loans

🧱 BENEFITS OF TOKENIZING ASSETS ON POLYGON

1.) Polygon was the first stop for many institutions exploring public-chain RWAs.

Polygon was one of the first networks built on top of Ethereum, leveraging its high security but offering a faster and more efficient infrastructure. This made it the go-to choice for many institutions exploring tokenized RWAs on public chains.

2.) Polygon's zk-proof digital identity system.

Polygon launched Polygon ID, a digital identity infra that allows users to verify themselves without revealing personal data.

As discussed in my previous piece on tokenized equities, having a digital identity infrastructure is crucial for tradFi and enterprises looking to tokenize their assets.

If you haven’t read it yet, you can check it out here:

3.) Polygon’s CDK for custom zk rollups.

Polygon’s CDK allows developers to build their own zk rollup and configure it based on their needs. For a tradFi institution, this could include enabling certain privacy features or mandatory KYC.

8.) @arbitrum

📊 TVL BREAKDOWN

DeFi TVL - $2.2B

Bridged TVL - $10.8B

RWA TVL - $164.8M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 7.5%

RWA TVL / Bridged TVL - 1.5%

DeFi TVL / Bridged TVL - 20.4%

Part of @Spiko_finance's products are also available on Arbitrum, with $25M nearly evenly split between European and U.S. treasury bills.

$137M, around 83% of the RWA TVL, comes from U.S. treasury bills issued by the previously mentioned players, while the remaining ≈$3M of tokenized assets are from @DinariGlobal's tokenized stocks.

It's worth noting that, although the total amount isn’t very high, Arbitrum is one of the very few chains that can showcase traction in tokenized stocks within its ecosystem.

🧱 BENEFITS OF TOKENIZING ASSETS ON ARBITRUM

1.) Thriving DeFi ecosystem

Arbitrum’s biggest strength lies in its mature and broad DeFi ecosystem. For asset tokenizers, this opens up a wide range of integrations and innovative use cases by leveraging the large pool of protocols and liquidity already on the network.

2.) Orbit stack

Similarly to other ecosystems, Arbitrum allows devs to launch their own L3 chain and configure it based on their requirements.

3.) Initiatives focused on the RWA sector

A big point in favor of Arbitrum is its public commitment to supporting the RWA sector on its chain.

In June 2024, the foundation invested $27M across six RWA products as part of a strategy to diversify the DAO treasury. An additional $15.5m was invested two months ago, always with the goal of expanding the RWA sector in its ecosystem.

9.) @avax

📊 TVL BREAKDOWN

DeFi TVL - $1.3B

Bridged TVL - $5.8B

RWA TVL - $162.9M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 12.5%

RWA TVL / Bridged TVL - 2.8%

DeFi TVL / Bridged TVL - 22.4%

From a ratio perspective, Avalanche doesn’t lean toward being either DeFi-centric or RWA-focused.

What sets Avalanche apart, however, is the diversity of institutional presence in its ecosystem, wider than most other chains mentioned so far.

We find again entities like @Securitize, @BlackRock, and @FTI_US, but also unique protocols like:

• @opentrade_io - $31M in U.S. and global bonds

• @re - $12M in insurance products

• @joinrepublic - $21M in venture capital portfolios

Avalanche is also the third-largest chain for BlackRock’s $BUIDL, just behind Ethereum and Aptos, with nearly the same share as Aptos.

🧱 BENEFITS OF TOKENIZING ASSETS ON AVALANCHE

1.) Subnets

Similarly to other ecosystems, developers can launch their own chains, L1s in the case of Avalanche, thus being able to:

• Choose validators

• Set compliance requirements (KYC, permissioned access)

• Custom VM logic or EVM-compatible

For instance, Avalanche Evergreen Subnets are well known for being institution-tailored and "maintain benefits of public network development while enabling particular features historically only possible within enterprise solutions".

2.) Avalanche is frequently included in institutional R&D and pilot programs

Major financial institutions have selected Avalanche as part of their tokenization proof of concepts (PoC). For instance:

• JPMorgan and Apollo Global conducted tokenization pilots via Onyx Digital Assets and Partior, using Avalanche’s testnet infrastructure.

• Citi has featured Avalanche in its research on programmable finance.

Being regularly involved in high-profile R&D improves the chain's reputation and positions it to attract more entities of that caliber.

3.) Initiatives and RWA-focused fund

Along with Arbitrum, Avalanche is the only ecosystem on this list with a publicly announced, dedicated initiative for RWAs.

In Q4 2023, Avalanche launched Avalanche Vista, a $50M fund aimed at accelerating RWA adoption. The fund focuses on purchasing tokenized assets minted on Avalanche, helping bootstrap liquidity for RWAs on the chain.

10.) @base

Lastly, by RWA total value, we've Base, the network that experienced the sharpest growth in TVL and activity over the past 18 months.

📊 TVL BREAKDOWN

DeFi TVL - $2.9B

Bridged TVL - $12.1B

RWA TVL - $51.9M

📋 KEY RATIOS

RWA TVL / DeFi TVL - 1.8%

RWA TVL / Bridged TVL - 0.43%

DeFi TVL / Bridged TVL - 23.9%

The data shows there is high DeFi activity on the chain, with the RWA growth still in its early stages.

The Majority of Base's RWA TVL comes from @FTI_US's U.S. treasury fund $BENJI, worth $46M.

The remaining ~$6M is managed by Centrifuge, also in the form of U.S. Treasury bills.

Interestingly, @DinariGlobal's stocks are also available on Base, but with very low traction compared to Arbitrum.

🧱 BENEFITS OF TOKENIZING ASSETS ON BASE

1.) Coinbase ecosystem advantage

While Base operates independently, it benefits from deep integration with Coinbase’s suite of tools and infrastructure. Developers can leverage resources such as Coinbase Wallet, native USDC support, and Prime Custody, significantly improving user experience, institutional-grade custody, and GTM strategies.

2.) Good DeFi composability

As highlighted above, although the RWA sector is still in its infancy, issuers on Base can count on a mature DeFi ecosystem and explore use cases for their assets, including potential integrations with Coinbase itself.

Think, for instance, about @CoinbaseWallet supporting BTC lending.

3.) Member of the OP ecosystem

Although it's a long-term vision, Base is a core member of the @Optimism Superchain, which aims to become an interoperable network of L2s. As this vision materializes, tokenized assets and users on Base will be able to interact with other OP chains, creating an attractive landscape for institutions to launch their own chains.

📗 FINAL CONSIDERATIONS

To sum it up, I believe configurable environments like Avalanche's subnets, Arbitrum Orbit, zkSync elastic chains, and Polygon CDK are very important.

Institutions want control over their environment without sacrificing the benefits of public networks. The ability to "isolate" parts of the chain while maintaining composability with DeFi protocols is a powerful selling point.

Another critical piece is digital identity infrastructure. Whether it ends up being Polygon’s DID or another emerging standard, institutions will need robust identity solutions to meet KYC, AML, and compliance needs while protecting user privacy.

If I had to rank the key factors to take into consideration when evaluating an ecosystem and its suitability for tokenizing assets, it would look like this:

1. Regulatory compliance

2. Configurable environments

3. Scalability & cost

4. DeFi composability

5. Proven security

While all these elements are essential, the ability to meet regulatory requirements and provide a secure, customizable environment are non-negotiable for institutional players.

It’s also important to remember that other elements, though not the focus of this piece, play critical roles.

• Integrated oracle networks

• Partnered custodians

• Native stablecoin support,

• Available tokenization infrastructure

• Interoperability with other chains.

Finally, I wouldn't underestimate the role of ETFs. Chains like Avalanche and Solana, which have open ETF filings for their tokens, may benefit from the increased legitimacy and awareness these bring to attract institutions and partners.

Feel free to share your thoughts or drop any feedback in the comments, and stay tuned for part n°2, where we'll dive into the upcoming wave of RWA-centric chains entering the market, such as @plumenetwork, @convergeonchain, @, and more.

Show original

79.46K

125

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.