Core Technical Advantages of INFINIT

1. Agent Swarm Architecture: Modular Intelligent Agent System

In simple terms, @Infinit_Labs has built an execution layer (Agent Swarm) composed of multiple AI agents that can collaborate across multiple chains and protocols to automatically perform complex DeFi operations such as swaps, lending, bridging, etc.

Its core capabilities include:

· Modular Composition: Call multiple agents on demand to achieve a complete strategy chain

· Deterministic Logic: The behavior of each agent is verifiable and predictable

· Strategy Simulation: Supports simulation and backtesting, ensuring "zero hallucination" before execution

Compared to most competitors in the market that focus solely on "packaging UI + multi-protocol interfaces," INFINIT achieves AI agent collaboration and dynamic strategy composition, resembling "AgentGPT for DeFi," with learning, adaptation, and interaction capabilities.

2. One-Click Strategy Execution + Strategy Compilation Layer

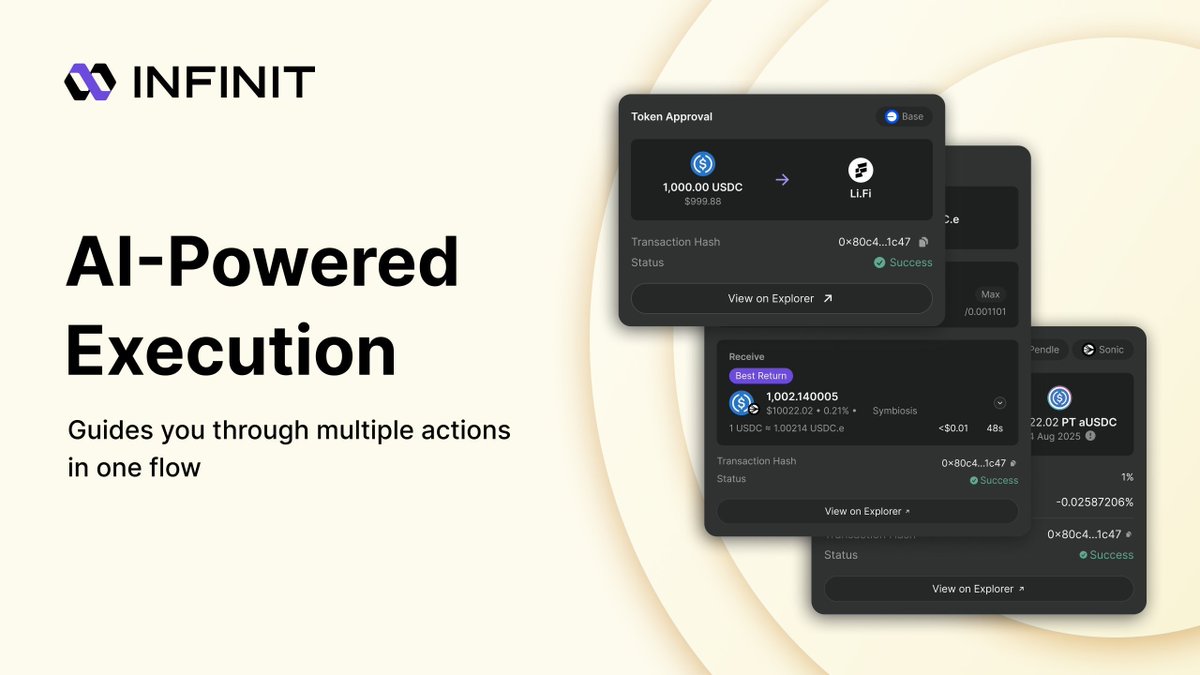

INFINIT completely reconstructs the user interaction process with "from prompt to one-click execution." Users only need to provide natural language prompts, and the system can generate complex on-chain strategies and compile them into verifiable deterministic code, avoiding the instability of traditional LLM output strategies.

All operations are packaged as a single atomic transaction, ensuring uninterrupted and failure-free execution. Technically, @Infinit_Labs is based on:

ERC-4337 (Account Abstraction)

EIP-7702 (Temporary Account Permissions)

This achieves a balance of flexibility and security in strategy execution.

3. Open Strategy Marketplace Mechanism

INFINIT introduces the "Strategy as Marketplace" mechanism, allowing anyone to easily write strategies through a natural language interface without programming knowledge.

Created strategies can be publicly listed for other users to call with one click. Strategy creators can earn revenue based on execution counts, and these strategies are treated as digital assets, with quantifiable metrics such as usage frequency, APY, and callers, building a transparent and rankable performance system.

Compared to most competitors that still use centralized strategy templates, INFINIT resembles an App Store for DeFi strategies: anyone can create, and anyone can execute.

4. Non-Custodial + Security Design

All operations by @Infinit_Labs are initiated directly from the user's wallet, with the platform not holding funds and no lock-up mechanism, ensuring users always retain asset sovereignty.

Strategy execution adopts an atomic packaging format, avoiding risks such as interruptions in intermediate steps or being captured by MEV; all operations can be rolled back, ensuring stability and security throughout the process.

Additionally, INFINIT has integrated over 100 data sources, covering both on-chain and off-chain data (on-chain + off-chain), including prices, liquidity, protocol TVL, governance trends, etc., enhancing the intelligent decision-making capability of strategy execution.

Therefore, INFINIT is not a traditional "DeFi tool" but has fundamentally transitioned from an "interactive tool" to an "intelligent execution system." Its underlying technical architecture, open market mechanism, and AI collaboration model make it a true representative of Agentic DeFi.

This is not only a productivity tool for professional DeFi players but also an intelligent financial infrastructure aimed at the general public.

AI-Driven: The Experience of Using Infinit Labs from an Ordinary User's Perspective

From the perspective of an ordinary user, interacting with @Infinit_Labs is actually a "worry-free" experience. In the past, if you wanted to engage in DeFi, you had to open multiple wallets, connect different chains, manually compare APYs, and worry about various authorization risks; just researching the process could take an entire day.

What Infinit Labs solves is precisely this: you don’t need to understand Solidity or Dune; as long as you can ask questions, the AI agent can help you complete the vast majority of on-chain strategy setups.

Let’s consider a more intuitive scenario:

For example, if I have some USDC and ETH in my wallet, normally, if I want to engage in yield farming and liquidity mining simultaneously, I would need to compare which pools have high yields and low fees, and authorize each one individually.

But with Infinit Labs' Discovery Agents, I only need to input "maximize USDC and ETH yields," and the AI will plan a cross-chain layout for me based on my wallet balance and risk preferences. For instance, it might suggest staking a portion on Polygon and doing lending on Arbitrum, and it will visually present these strategies and expected yields for my confirmation. If I’m not satisfied, I can continue to fine-tune.

This experience feels more like using Web2 financial products, such as funds or smart investment advisors, except the backend is powered by AI and blockchain technology. This aspect is particularly appealing to newcomers, as it saves a lot of cumbersome on-chain operations.

Community Interaction Incentives

I find it quite interesting that Infinit Labs encourages community interaction through the $IN token. Many DeFi projects have rather rigid communities, but Infinit encourages users to publish content, share insights, and participate in leaderboards, directly using tokens as a reward mechanism. This gives users both the motivation to "earn yields" and a sense of belonging to the "community."

Safety is also not a concern; Infinit Labs has solid practices regarding transparency and user control. Users must confirm transaction signatures before any operation, and all processes are non-custodial, meaning the platform itself does not hold user assets. This is particularly important in the current context of frequent risks in the DeFi industry.

Overall, Infinit Labs represents a significant upgrade in experience compared to traditional DeFi platforms: you no longer need to understand too many complex operations; instead, you can let AI handle the details.

In summary, for ordinary users, it sufficiently lowers the entry barrier. It can be described as a new model where "an AI that understands DeFi manages your on-chain assets." Interested folks can come and experience it:

@KaitoAI #Kaito #Yapper

3.5K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.