DeFi without RWAs is going to die.

But RWAs won't grow without tradFi.

We need tailored infrastructure.

However, DeFi and tradFi are very different worlds.

DeFi composability and tradFi's compliance are two challenging concepts to combine, but @RaylsLabs is trying to do it with its UniFi Blockchain.

Rayls combines permissioned and permissionless infrastructure to deliver a solution that fits institutional requirements without sacrificing the benefits of an open DeFi ecosystem.

As with the previous parts of this series, let’s start by diving into the tech to understand how the ecosystem operates.

⚙️ THE TECH

Rayls is building an ecosystem made of different networks encapsulated and interconnected with each other. The infrastructure is composed of four main parts:

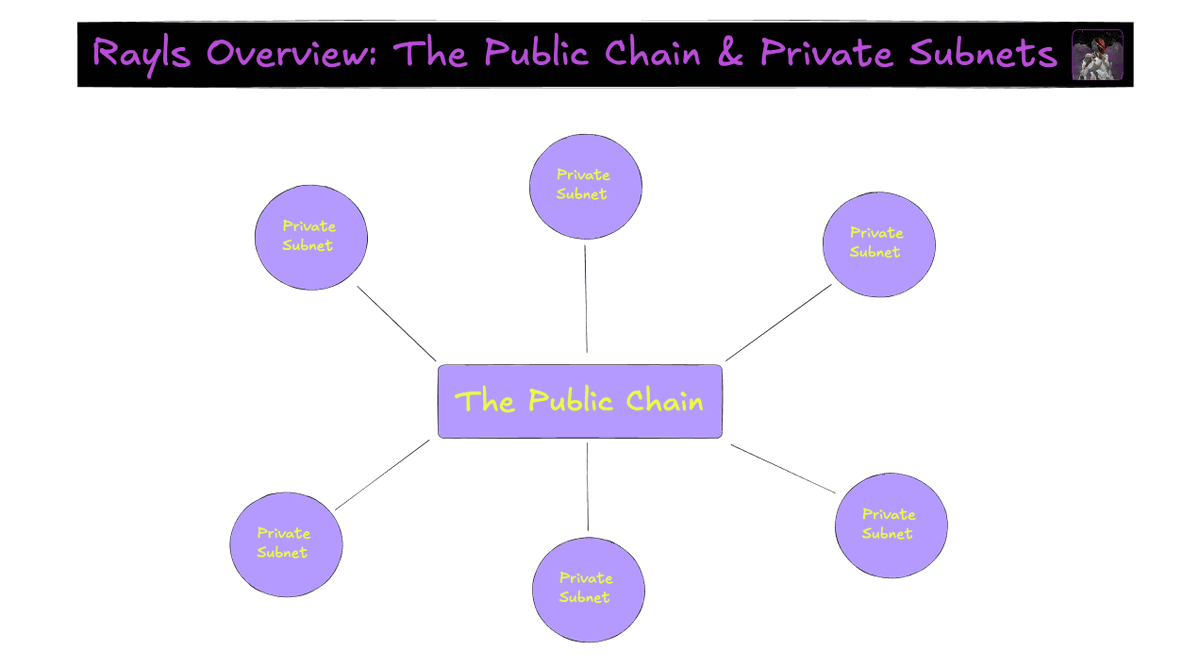

1.) The Public Chain

2.) Private Subnets

3.) The Commit Chain

4.) Privacy Ledgers

Let's go deeper into each component 👇

1.) Key Points About the Public Chain

Rayls' Public Chain is an Ethereum L2 powered by @arbitrum that requires mandatory KYC from all users.

The KYC process is done via open banking APIs to verify users' data while preserving their privacy (no data is stored on/off-chain).

Despite being KYC-gated, the chain will be permissionless and interoperable with the rest of DeFi. Users and devs can launch and use apps, tokens, and so on, as in any other ecosystem.

With this setup, as all users are KYCed, institutions will be more comfortable interacting with them and DeFi protocols in the ecosystem, thus unlocking a lot of opportunities for new capital and demand to flow onchain.

2.) Key Points About Private Subnets

Surrounding the Public Chain, there will be multiple Private Subnets, which are permissioned networks tailored for institutions.

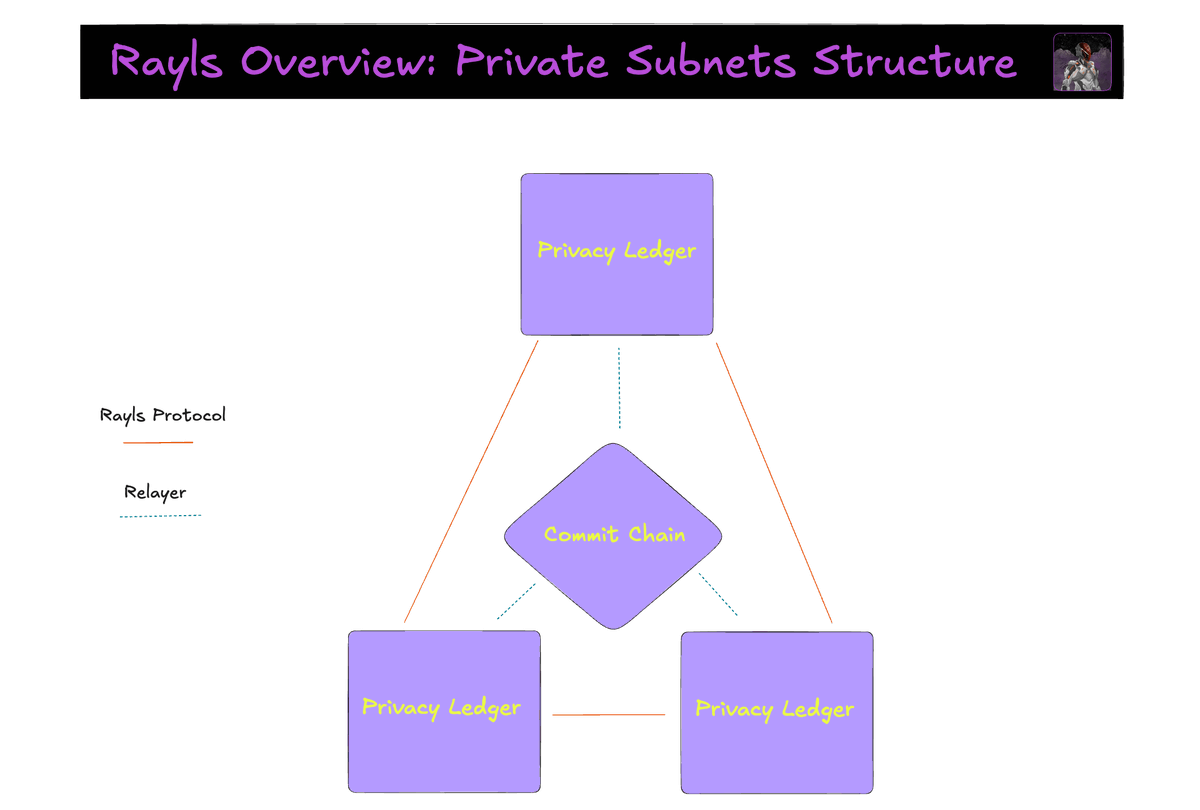

Each Private Subnet consists of:

• A Commit Chain (the hub)

• Many Privacy Ledgers (the spokes)

Finally, each Subnet is connected to the main Rayls Public Chain.

An interesting feature is that when a subnet is created, a Governor and an Auditor are assigned to respectively rule and oversee it.

• Governor - manages governance rules and changes how the Subnet operates.

• Auditor - monitors transaction activity (transactions that pass through the Commit Chain and not inside Privacy Ledgers) and informs the Governor about anything suspicious.

(Check image n°1)

3.) Key Points About the Commit Chain

The Commit Chain is an EVM-compatible chain at the center of each Private Subnet that orchestrates all transfers between the Privacy Ledgers.

This is done by leveraging Rayls Relayers, a privacy-preserving messaging layer that handles communication and transfers between the Privacy Ledgers and the Commit Chain.

By ensuring that all transactions are relayed, validated, and recorded with full integrity, the Relayer plays a critical role in maintaining trust and reliability inside a subnet.

Imagine the structure like this:

Commit Chain <> Relayer <> Private Ledgers

(Check image n°2)

4.) Key Points About Privacy Ledgers

The last piece of the puzzle is Privacy Ledgers, which can send and receive tokens between each other.

Rayls is building the ecosystem to ensure all transactions are encrypted and hidden from other participants in the Subnet.

This enables institutions to create accounts for their clients in total privacy, issue tokens in total privacy, and transact with other institutions in total privacy.

In this case, the interop between Privacy Ledgers inside a Subnet is handled by the Rayls Protocol, an end-to-end private transfer solution.

Imagine the structure this way:

Privacy Ledger ⇄ Rayls Protocol ⇄ Privacy Ledger

(Check image n°2 again)

📈 OPPORTUNITIES & USE CASES

1.) There is a concrete chance to see both existing and new protocols to partner with TradFi players and deploy tailored apps inside their subnets.

This would require teams to work closely with these entities and likely invest more resources than deploying on another chain, but the benefits might outweigh the efforts as they will have access to an exclusive pool of clients and liquidity.

2.) A second concrete use case is a multi-CBDC payments infrastructure where different governments set up a subnet or multiple subnets, with a bank being the settlement and coordinating party.

This model was explored during a PoC in the past months and featured in the G20 TechSprint Report published in October 2024.

🌎 LATAM EXPANSION & INSTITUTIONAL ADOPTION

@parfin_io, the parent company of Rayls, has strong ties with enterprises and institutions across South America, which has facilitated Rayls’ use in multiple PoCs and institutional tests in recent months.

The key initiatives that Rayls was involved with include:

1.) Drex - Brazil CBDC

Rayls was chosen by the Central Bank of Brazil (Bacen) as the privacy solution for Drex, the country’s official CBDC.

"For any tokenized asset process—and by tokenized asset, we mean anything that can generate value—it is essential to settle transactions. To settle, a fiat currency is needed, and for a fiat currency to be used within blockchain technology, it must also be tokenized”

The initiative involved 16 banks, the Central Bank of Brazil, and Rayls. According to the team, at least five of those institutions are continuing to test and engage with its infrastructure.

For banks and financial institutions, CBDCs pose a challenge to traditional revenue streams like transaction fees and spreads. Instead of serving as intermediaries, banks might pivot to providing transaction infrastructure or liquidity bridges for tokenized assets.

The key highlights of the tests are:

• Drex transfers between financial institutions (FIs)

• Tokenised Real/Drex transactions between FIs' clients

• Trading (DvP Method - Delivery vs Payment) of tokenized Federal Public Securities (TPFt) between FIs

• Trading (DvP) of TPFt between FI clients

2.) Brazil's Largest FinTech Infrastructure Provider

A bit of context: Nuclea is Brazil’s largest provider of financial technology infrastructure. In 2022 alone, the company processed over 31 billion transactions, totaling more than BRL 19 trillion (2x Brazil’s GDP).

Núclea manages 100% of invoice registrations and 90% of debit and credit card settlements in Brazil.

Although not much information has been provided on this topic, Nuclea is exploring blockchain tech, specifically Rayls, to advance its infrastructure and explore tokenization use cases.

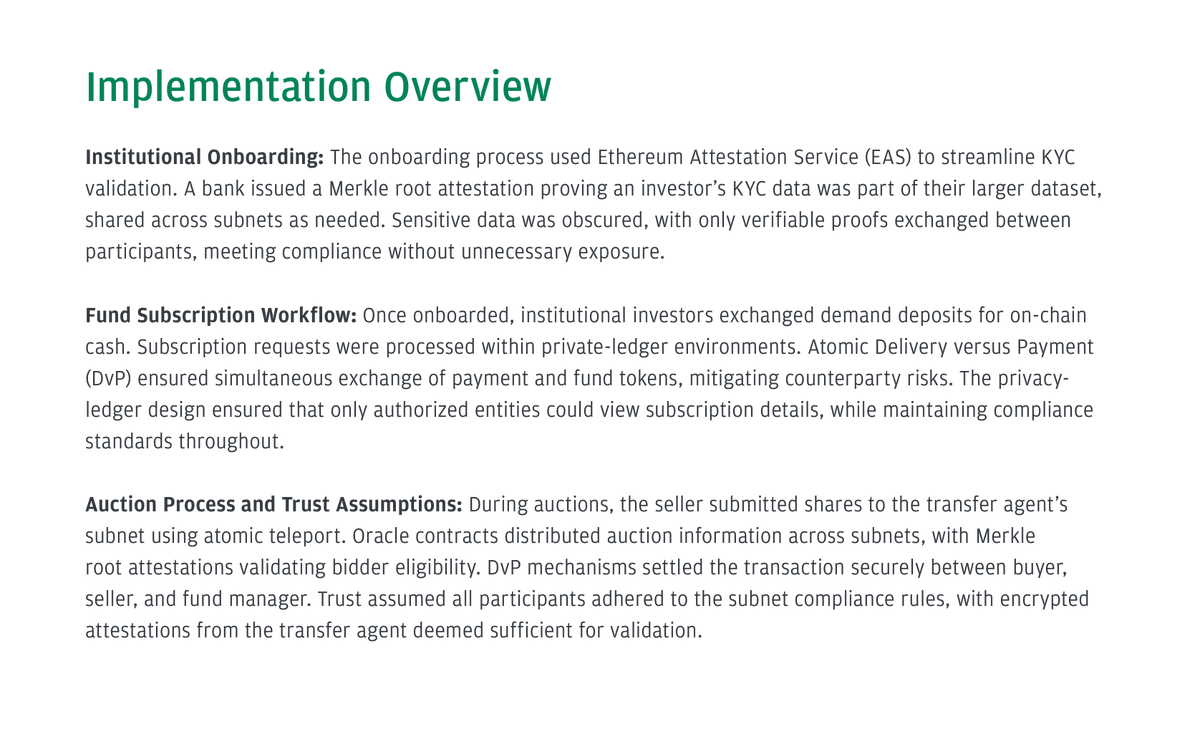

3.) J.P. Morgan's EPIC Program

In November of last year, in a report by J.P. Morgan's blockchain unit, Rayls was highlighted as a partner participating in Project EPIC for exploring privacy and identity solutions tailored for institutions.

The official announcement states: “In Parfin’s implementation, Rayls showcased a secure and compliant system for global, institutional transactions.”

(Check image n°3)

Everyone is talking about RWAs.

But no one is speaking about the elephant in the room.

A $1.8 Quadrillion industry that only a few protocols are targeting.

In the third part of this series, we'll focus on @Mantle_Official, which is positioning itself as a "financial hub" at the intersection of Web3 and Web2 with its latest two products:

• Mantle Index Four (MI4)

• Mantle Banking

Before diving into them and into Mantle's vision, a bit of context:

⚙️ THE TECH

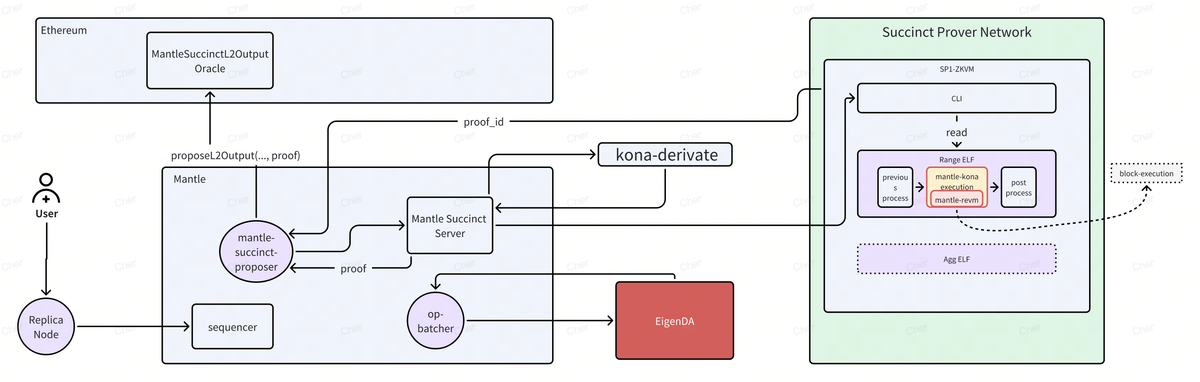

Mantle Network is an EVM-compatible Layer 2 that integrates @eigen_da for data availability and @SuccinctLabs for zero-knowledge proving to provide institutions with a scalable infrastructure to build on.

Both integrations were made this year and represent key steps in Mantle's shift from an optimistic to a zero-knowledge rollup.

The original OP Proposer was replaced with the new Mantle Succinct Proposer, responsible for submitting ZK proofs to Ethereum L1. In parallel, @SuccinctLabs's SP1 Prover Network was integrated to delegate more compute-intensive ZKP generation tasks to a professional network, thus enhancing the chain's performance and scalability.

One of the main upgrades was replacing the original OP Proposer with the Mantle Succinct Proposer, responsible for submitting ZK proofs of Mantle's state changes to Ethereum L1. In parallel, to handle more compute-heavy tasks while maintaining high performance, Mantle also integrated @SuccinctLabs’s SP1 Prover Network to delegate those tasks to its specialized network.

(See image n°1 for a breakdown)

About the EigenDA integration, previously used a custom solution built on top of EigenDA, while now it directly leverages EigenDA’s solution. This allows the chain to scale data availability further without compromising security.

Now that we've recapped how Mantle distinguishes itself from other networks, let's dive into the core topics of this piece.

🏦 MANTLE BANKING

Mantle Banking is a crypto neobank that lets you manage fiat and crypto in one account, making it easy to receive, spend, and invest in both.

The platform allows users to set up a Swiss bank account and receive a globally accepted virtual debit card.

While launching such a service isn’t very difficult, there are two recurring problems most startups in this vertical face:

1.) Third-parties Dependency

2.) Web3 <> Web2 Interoperability

1.) Third-parties Dependency

Most startups launching these products don't control the underlying infra and, therefore, have a weak position when it comes to customer acquisition costs (CAC) and Lifetime value (LTV).

This is because:

1. They pay fees to external providers (e.g., custodians, payment processors, offramps, bridges).

2. They rely on their rules, uptime, and costs.

Ultimately, these two aspects increase the cost of serving customers and lower margins.

On top of that, users expect everything in one place. If your platform doesn’t offer spending, saving, investing, borrowing, and so on, they’ll quickly move towards whoever provides all of these.

2.) Web3 <> Web2 Interoperability

The second issue is most crypto apps can't properly connect to traditional banks or brokerages.

From on-ramping limitations (high fees, geo limitations, etc.) to banks limiting you once you interact with crypto apps, the UX is horrible.

Mantle nails these two problems by owning all parts of the value chain, from the blockchain to the banking one. This allows them to customize each layer of the stack and stay competitive in the market.

The mantle team outlined how ultimately capturing salaries via direct deposit into their neobank is the objective they're working toward.

From there, the use cases would be many, such as:

• Swap & send fiat currencies (USD, EU, SGD, etc.)

• Pay across platforms and merchants

• Interact with Mantle's DeFi Ecosystem

(Check image n°2)

🌐 THE PAYFI VISION

• The global payments industry records an annual transaction volume of $1.8 quadrillion.

• Total revenue across the sector reached $2.2 trillion in 2023 and is projected to surpass $3 trillion by 2030.

• Cross-border payments exceeded $150 trillion in volume in 2023.

• Digital wallets account for over 50% of global e-commerce payments and are expected to rise to 60% by 2026.

This is the scale of the payments industry today. However, most of this value still moves on traditional infrastructure.

And that's where the concept of PayFi comes in.

PayFi, aka Payment Finance → the merge of stablecoins, tokenized assets, and DeFi with legacy payment rails.

PayFi is based on the principle of the Time Value of Money, the idea that a dollar today is worth more than its value in the future because it can be invested or lose value due to inflation.

I'm briefly outlining this because it's exactly where Mantle wants to position itself with the Banking platform.

We're entering the phase where CEXs, L1s, and L2s will scale from targeting traders and DeFi users to the masses. This won't be done by creating some crazy DeFi apps that most of the population wouldn't be able to understand but by serving them what they already use daily.

Onchain and offchain worlds are converging, with CEXs, ecosystems, and FinTech giants racing to capture their share of the pie.

📈 MANTLE INDEX FOUR (MI4)

Simply put, the yield-bearing S&P 500 of crypto.

MI4 is a tokenized fund that offers diversified exposure to yield-bearing assets, with @Securitize as the tokenization partner, @FireblocksHQ as the custody provider, and the Mantle Treasury as the main investor by committing $400M from its balance.

The reason MI4 is very interesting is its institutional-focused approach, as it provides a relatively low-risk, index-based product that’s familiar to traditional investors.

On top of that, it bakes in yield generation, making it even more attractive to asset managers and funds.

The yield comes from blue-chip staking strategies like:

• @mETHProtocol's mETH

• @Bybit_Official’s bbSOL

• @ethena_labs’ sUSDe

These allocations are rebalanced quarterly, and the current fund's structure looks like this:

• BTC - 50%

• ETH - 28%

• USD - 15%

• SOL - 7%

What's remarkable about MI4 is that it's @Securitize’s largest tokenized fund, demonstrating Mantle's commitment to attracting more institutional participation and expansion beyond a generic-purpose L2.

🌱 INITIATIVES TO DRIVE THE INDUSTRY FORWARD

Lastly, as we did in the previous pieces, it's worth mentioning the initiatives Mantle is carrying out to increase ecosystem adoption and global expansion.

1.) Mantle EcoFund - Launched in 2023, it's a $200M fund investing in startups building in the Mantle ecosystem. The fund is also invested in Synergy, a $5 million initiative in collaboration with TON Ventures to advance cross-chain developments between the two networks.

2.) LATAM Expansion - In partnership with @odisealabs, Mantle is engaging with local developers, entrepreneurs, and communities, providing resources and support to accelerate Web3 adoption across the region. This is also part of a bigger vision, in which LATAM will be a main propeller of Mantle Banking's adoption.

23.33K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.